Coronavirus: A Seven-Point Action Plan for G20

- blog de anegrete

- 3001 lecturas

On March 26, 2020, an extraordinary virtual G20 Leaders’ Summit will take place to discuss global plans to tackle the public health and economic challenges posed by the coronavirus pandemic (COVID-19). The Leaders’ Summit will follow a virtual meeting of G20 Finance Ministers and Central Bank Governors that was held on March 23 and a virtual G20 Sherpa meeting to be held on March 25.

As anticipated, the G20 finance ministers did not issue a joint declaration after the call. Media reports suggest that no consensus was reached on releasing a joint declaration due to recent tensions between the US and China over trade issues and the origin of the coronavirus.[1]

The G20 Saudi secretariat only issued a press release stating that “G20 Finance Ministers and Central Bank Governors agreed to closely monitor the evolution of the COVID-19 pandemic, including its impact on markets and economic conditions and take further actions to support the economy during and after this phase. They also agreed to develop a joint G20 Action Plan in response to COVID-19, which will outline the individual and collective actions that G20 has taken and will be taking to respond to the COVID-19 pandemic.”[2]

The press statement provides no further information about what specific individual and collective policy actions would constitute the G20 Action Plan. The G20 finance ministers issued a somewhat similar joint statement (on March 6) promising “actions, including fiscal and monetary measures, as appropriate, to aid in the response to the virus, support the economy during this phase and maintain the resilience of the financial system.”[3] For more details on the G20 Action Plan, perhaps we may have to wait until the Leaders’ Summit taking place on Thursday.

More than bland statements, the world urgently needs is coordinated action plans (with concrete steps, resources required, deadlines, and accountabilities) to address the triple crisis — a health crisis, a real economy crisis, and a looming financial crisis triggered by unprecedented capital outflows and credit stress.

Apart from the immediate global health policy response to strengthen health infrastructure, well-coordinated economic policy actions are needed to restart the economy and protect the most vulnerable countries. Given the scare resources, a coordinated multilateral strategy would be mutually reinforcing and would create significant positive spillover effects for all countries. Hence, countries should initiate joint actions and seek greater international coordination in all policy areas to produce better outcomes.

The following are seven key issues for action that G20 could collectively undertake to address the public health crisis and the corresponding economic fallout of the coronavirus pandemic.

1. Enhance Medical Aid and Collaborations

First and foremost, given the transmission of coronavirus across six continents, G20 should ensure that the movement of essential medical supplies (such as masks, gloves, and other medical equipment) should not be restricted across borders and should be offered to all those countries that need them.

The export restrictions on essential medical supplies imposed by the EU and some national governments should be immediately removed as many countries lack the domestic production of medical supplies to deal with the pandemic. Such short-sighted export controls are obstructing global efforts by governments, foundations, and NGOs to send essential medical supplies to affected countries.

Further, the US, China, and Europe should jointly collaborate on many levels in developing and testing a vaccine against the coronavirus. Currently, there are no bilateral or multilateral collaborations to develop a vaccine or other treatments. Needless to add, the conduct of multiple testing programs across various jurisdictions enhances the success of vaccines.

Once a vaccine is approved and successfully launched, it should be offered to people around the world affordably, and regardless of economic or geostrategic considerations. Saving human lives is far more critical than seeking monopoly privileges or pursuing geostrategic goals.

The coronavirus pandemic has, once again, highlighted the need to provide substantial financial support to the WHO to meet the current and future health epidemics.

2. Financial Mobilization and Coordination

G20 should provide significant financial assistance through grants and concessional loans to the poor and developing countries that desperately need funds to augment their public health infrastructure and to revive the economy.

In this regard, G20 needs to adopt a multipronged approach and extend support to myriad international initiatives.

The IMF has made available $50 billion through its twin emergency financing facilities — the Rapid Credit Facility (RCF) and the Rapid Financing Instrument (RFI) — to the poor and developing countries affected by the coronavirus.[4] Besides, the IMF has recently expressed its willingness to mobilize an additional $1 trillion to assist its member countries.

Both these initiatives by the IMF could be effective provided loans do not prescribe fiscal tightening measures and are not denied to member-countries (for instance, Iran or Venezuela) that may have political or strategic differences with some of the biggest shareholders of the Fund.

Since mobilizing $1 trillion may take considerable time in getting approval from its largest shareholders, the IMF could devote more resources to its twin emergency financing facilities in the near terms. On March 23, Kristalina Georgieva, the managing director of the IMF, informed that as many as 80 member-countries are seeking help from the Fund.[5] Hence, $50 billion may not be adequate to meet the immediate financing needs of 80 countries.

Further, the funds under the RFI facility should be made available to countries at zero interest rates, with repayment over ten years. Some of the preconditions attached to securing financial support under the RFI should be relaxed for countries dealing with the global pandemic.

Apart from the IMF, financial support from regional and international financial institutions should be mobilized. For instance, the World Bank can play an essential role in reviving trade finance, as it did during the 2008 global financial crisis.

Norway has proposed to establish a coronavirus fund[6] at the United Nations to assist poor countries facing the virus epidemic, similar to Ebola Response Multi-Partner Trust Fund established in response to the Ebola outbreak in 2014 by the UN. Such financing initiatives need to be welcomed by the G20 and international community.

Apart from resource mobilization, international coordination of financing initiatives is equally important. Ideally, the UN is well-placed to coordinate myriad financing initiatives, given its strong commitment to the Sustainable Development Goals (SDGs) along with the active participation of poor and developing countries in the decision-making processes.

3. Extend US Dollar Swap Lines

The G20 should request the US to extend dollar swap lines to large emerging markets (such as Turkey, Argentina, and South Africa) that are facing a dollar funding squeeze. Currently, the US Federal Reserve has offered swap lines to just four EMEs: Singapore, South Korea, Mexico, and Brazil.

There are regional financing arrangements (RFAs) such as Chiang Mai Initiative, Arab Monetary Fund, BRICS Contingent Reserve Arrangement, and Latin American Reserve Fund that have been established to provide financial support to countries experiencing financial difficulties. However, since most member-countries of the RFAs are also experiencing financial problems, large financial support from such arrangements may not be available in the present circumstances.

4. Coordinate Macroeconomic Policies

The G20 should take the lead in coordinating a wide range of macroeconomic policies to avoid the beggar-thy-neighbor policies, as it did so in the wake of the 2008 crisis.

Although most fiscal stimulus measures are likely to be targeted at sub-national and national levels by governments, G20 should task the Financial Stability Board (FSB) to explore a coordinated and synchronized global fiscal response that can mitigate the economic downturn and protect the most vulnerable economies.

Unlike advanced economies, most developing and emerging economies lack social safety nets that can serve as automatic fiscal stabilizers by boosting fiscal spending during economic downturns.

Special attention needs to be given to support households and small and medium enterprises badly hit by simultaneous supply and demand shocks.

5. Regulate Volatile Capital Flows

The G20 should pledge to do “whatever it takes” to preserve macroeconomic and financial stability. In particular, G20 leaders should strongly endorse the use of capital controls to stem rapid outflows currently experienced by several EMEs as panicked investors are dumping assets in exchange for the US dollar.

Capital outflows from the EMEs have exceeded $70 bn since the beginning of the coronavirus outbreak. The Institute of International Finance has noted that fund outflows from EMEs since late January “are already twice as large as in the global financial crisis and dwarf stress events such as the China devaluation scare of 2015 and the taper tantrum in 2014.”[7]

A sudden surge in capital outflows can trigger large depreciation of EM currencies, which in turn increases the domestic value of foreign currency debts and could trigger sovereign and corporate defaults. The foreign exchange interventions and liquidity provisions have their limitations, and therefore, policy actions are needed to regulate volatile capital flows.

A strong statement by G20 leaders endorsing capital controls would immensely help in removing the deeply-rooted stigma attached to capital controls. The G20 should task the FSB or the IMF to coordinate actions on capital controls. The G20 should also direct the IMF to update its 2012 institutional view that endorses capital controls only as a last resort and imposed selectively on capital inflows.

Besides, G20 leaders’ endorsement of other regulatory measures (such as a ban on short-selling, and enhanced surveillance of high-frequency trading) would encourage national regulators to undertake all necessary preventive measures to maintain market integrity.

6. Grant Substantial Debt Relief

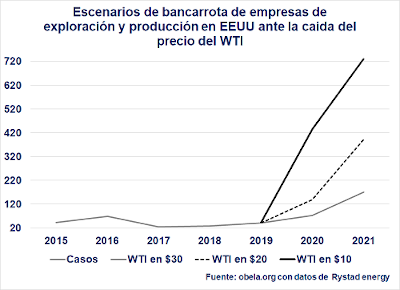

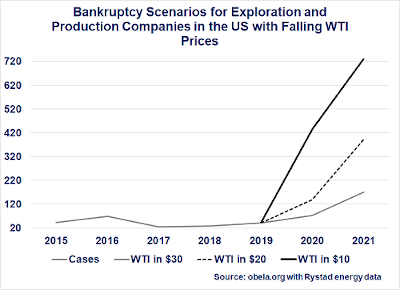

The sudden stop in capital flows coupled with a sharp decline in commodity prices has further complicated external financing of many developing and emerging economies. Almost half of the EMEs are commodity exporters. Some countries are finding it difficult to service their foreign currency debt as their debt levels were unsustainable well before the coronavirus outbreak. In early March, Lebanon defaulted on its foreign currency debt. Argentina desperately needs substantial debt restructuring to avoid a sovereign default.

G20 should support substantial debt relief to all those countries that are facing a full-blown debt crisis. A moratorium on debt repayments by multilateral lenders and foreign creditors would enable countries to devote more resources to fight the pandemic.

7. Resolve Bilateral Disputes

This is the time for international solidarity, not for trade wars and sanctions. The G20 countries should resolve two major ongoing bilateral disputes — a trade war between the US and China; and an oil price war between Saudi Arabia and Russia.

The trade and oil price wars weaken international cooperation at a time when it is badly needed to fight the coronavirus pandemic.

At the very least, the G20 member-countries should hit the pause button on their bilateral trade and oil price disputes until the world fully recovers from the coronavirus and its economic effects.

Endnotes

[1] Patrick Wintour, “G20 finance ministers’ talks hampered by US-China standoff,” The Guardian, Available at: https://www.theguardian.com/world/2020/mar/23/g20-finance-ministers-talk....

[2] Press Release, G20 Finance Ministers and Central Bank Governors Virtual Meeting, March 23, 2020. Available at: https://g20.org/en/media/Documents/FMCBG_Extraordinary_Press%20Release.pdf.

[3] Statement on COVID-19, G20 Finance Ministers and Central Bank Governors, March 6, 2020. Available at: https://g20.org/en/media/Documents/G20%20Statement%20on%20COVID-19%20-%2....

[4] IMF Makes Available $50 Billion to Help Address Coronavirus, Press Release, IMF, March 4, 2020. Available at: https://www.imf.org/en/News/Articles/2020/03/04/sp030420-imf-makes-avail....

[5] IMF Managing Director Kristalina Georgieva’s Statement Following a G20 Ministerial Call on the Coronavirus Emergency, IMF, March 23, 2020. Available at: https://www.imf.org/en/News/Articles/2020/03/23/pr2098-imf-managing-dire....

[6] Gwladys Fouche, “UN to create global coronavirus fund, Norway says,” Reuters, March 23, 20202. Available at: https://www.reuters.com/article/us-health-coronavirus-unitednations-norw....

[7] Sergi Lanau and Jonathan Fortun, “The Covid-19 Shock to EM Flows,” Economic Views, Institute of International Finance, March 17, 2020.

2021: Year of Living Dangerously?

- blog de anegrete

- 2366 lecturas

KUALA LUMPUR, Malaysia, Jan 5 2021 (IPS) - Goodbye 2020, but unfortunately, not good riddance, as we all have to live with its legacy. It has been a disastrous year for much of the world for various reasons, Elizabeth II’s annus horribilis. The crisis has exposed previously unacknowledged realities, including frailties and vulnerabilities.

For many countries, the tragedy is all the greater as some leaders had set national aspirations for 2020, suggested by the number’s association with perfect vision. But their failures are no reason to reject national projects. As Helen Keller, the deaf and blind author activist, noted a century ago, “The only thing worse than being blind is having sight, but no vision.”

After JFK’s assassination in November 1963 ended US opposition to Western intervention in Indonesia, President Sukarno warned his nation in August 1964 that it would be ‘living dangerously’, vivere pericoloso, in the year ahead. A year later, a bloody Western-backed military coup had deposed him, taking up to a million lives, with many more ruined.

Further economic slowdown

Lacklustre economic growth after the 2009 Great Recession has been worsened in recent years by growing international tensions largely associated with US-China relations, Brexit and slowing US and world growth although stock markets continued to bubble.

Economic growth has slowed unevenly, with Asia slowing less than Europe, Latin America and even the US. With effective early pre-emptive measures, much of East Asia began to recover before mid-2020. Meanwhile, most other economies slowed, although some picked up later, thanks to successful initial contagion containment as well as adequate relief and recovery measures.

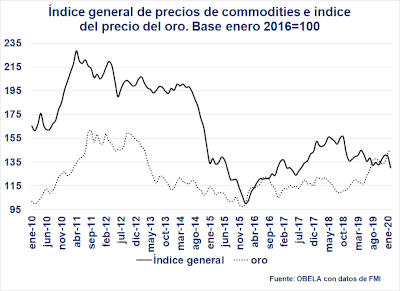

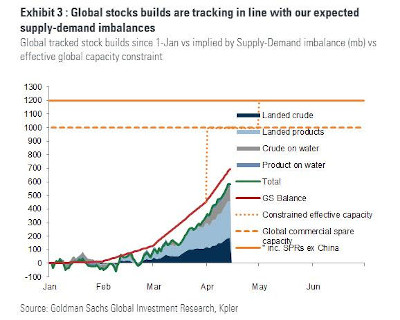

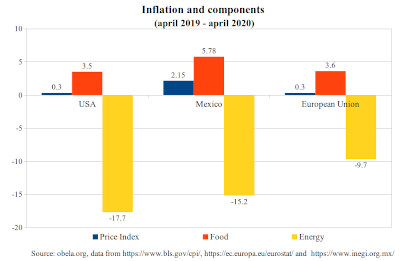

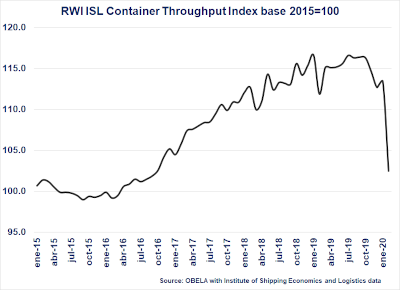

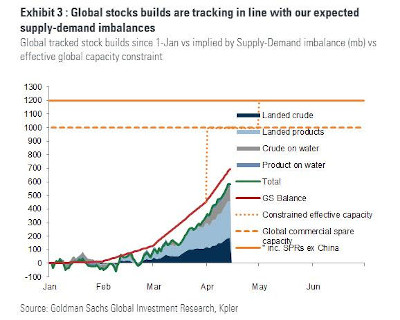

International trade has been picking up rapidly, accelerating rebounds in heavily trading economies. Commodity prices, except for fossil fuels, have largely recovered, perhaps due to major financial investments by investment banks and hedge funds, buoying stock and commodity prices since late March.

Very low US, EU and Japanese interest rates have thus sustained asset market bubbles. Meanwhile, new arbitrage opportunities, largely involving emerging market economies, have strengthened developing countries’ foreign reserves and exchange rates, thus mitigating external debt burdens.

Unbiased virus, biased responses

The pandemic worsened poverty, hunger and vulnerability by squeezing jobs, livelihoods and earnings of hundreds of millions of families. As economic activities resumed, production, distribution and supply barriers, constrained fiscal means, reduced demand, debt, unemployment, as well as reduced and uncertain incomes and spending have become more pronounced.

While many governments initially provided some relief, these have generally been more modest and temporary in developing countries. Past budget deficits, debt, tax incentives and the need for good credit ratings have all been invoked to justify spending cuts and fiscal consolidation.

Meanwhile, pandemic relief funds have been abused by corporations, typically at the expense of less influential victims with more modest, vulnerable and precarious livelihoods. Many of the super-rich got even richer, with the US’s 651 billionaires making over US$1 trillion.

On the pretext of saving or making jobs, existing social, including job protection has been eroded. But despite hopes raised by vaccine development, the crisis is still far from over.

Don’t cry for me, says Argentina

Meanwhile, intellectual property blocks more affordable production for all. Pharmaceutical companies insist that without the exhorbitant monopoly profits from intellectual property, needed tests, treatments and vaccines would never be developed. Meanwhile, a proposed patent waiver for Covid-19 vaccines has been blocked by the US and its rich allies at the World Trade Organization (WTO).

Hence, mass vaccination is likely to be very uneven and limited by intellectual property, national strategic considerations (‘vaccine nationalism’), prohibitive costs, fiscal and other constraints. Already, the rich have booked up almost all early vaccine supplies.

The main challenge then is fiscal. Economic slowdowns have reduced tax revenues, requiring more domestic debt to increase spending needed to ensure the recessions do not become protracted depressions. Meanwhile, rising debt-to-GDP ratios and increased foreign debt have long constrained bolder fiscal efforts.

But despite the urgent need for more fiscal resources, we are told that if the richest are required to pay more taxes, even on windfall profits, they will have no incentive to ‘save’ the rest of us. Nevertheless, new wealth taxes have just passed in Argentina.

This time is different

As the pandemic economic impacts began to loom large, International Monetary Fund Managing Director Kristalina Georgieva quickly offered debt relief for low-income countries on terms much better than the G20’s miserly proposal.

Unlike well-meaning debt-fixated researchers and campaigners, even new World Bank chief economist, erstwhile debt hawk Carmen Reinhart has urged, “First you worry about fighting the war, then you figure out how to pay for it”.

Nobel laureate Amartya Sen is concerned that “in the policies against the present pandemic, equity has not been a particularly noticeable priority… Instead, the focus has been on drastic control and sudden lockdowns…with little attention paid to labourers who lose their jobs or the many migrant workers, the poorest of the poor, who are kept hundreds of miles from their homes”.

COVID-19 may still bring major reforms, such as Roosevelt’s New Deal response to the Great Depression. But now, it seems likely to usher in a world where insecurity and unpredictability define the new normal. While professing to protect victims’ interests, ethno-populism blames ‘Others’ as the enemy responsible.

Still, many hope for a silver lining. Sen suggests that “a better society can emerge from the lockdowns”, as happened after World War Two, with greater welfare state provisioning and labour protections in much of the West and agrarian reforms in East Asia. But there is nothing to guarantee a better ‘new normal’.

Beyond neoliberalism?

For many, Joe Biden’s election to succeed Trump is being celebrated as a resurgent triumph for neoliberalism, enabling the US and the rest of the world to return to ‘business as usual’.

Incredibly, another Nobel laureate Michael Spence has even called for structural adjustment programme conditionalities for countries seeking help from the Bank and Fund, repudiating the Bank’s Growth Commission he once chaired, i.e., which found that seemingly fair, often well-intentioned conditionalities had resulted in “lost decades” of development.

But thankfully, there is widespread recognition that all is not well in the world neoliberalism and Western dominance created. Incredibly, Klaus Schwab, transnational capitalism’s high priest, has conceded, “the neoliberalist … approach centers on the notion that the market knows best, that the ‘business of business is business’…Those dogmatic beliefs have proved wrong”.

Instead, he advised, “We must move on from neoliberalism in the post-COVID era”, recognising: “Free-market fundamentalism has eroded worker rights and economic security, triggered a deregulatory race to the bottom and ruinous tax competition, and enabled the emergence of massive new global monopolies. Trade, taxation, and competition rules that reflect decades of neoliberal influence will now have to be revised”.

Will we ever learn?

The philosopher Santayana once warned, “Those who cannot remember the past are condemned to repeat it.” Hegel had observed earlier that history repeats itself, to which Marx added, “the first time as tragedy, the second time as farce”. Nevertheless, hope remains an incurable disease that keeps us all striving and struggling.

As FDR reminded his supporters, no progressive policies will come about simply by relying on the goodwill of those in authority. Instead, they will only be enacted and implemented thanks to popular pressure from below. As Ben Phillips has put it, “the story of 2021 has not yet been written: we can write it; we can right it”.

A global health crisis? No, something far worse

- blog de anegrete

- 3338 lecturas

Every evening we scour those graphs looking for signs that the epidemic is in retreat. New cases of coronavirus disease 2019 (COVID-19). People in hospital with COVID-19. Critical care beds with COVID-19 patients. Daily COVID-19 deaths in hospital. And then the final and bluntly worded “global death comparison”. Those with responsibility for leading us through this emergency have called it “a once in a century global health crisis”. This statement is incorrect on two grounds. First, because we cannot know what the rest of the century will bring. It is highly probable that this current pandemic will be neither the last nor the worst global health crisis of the present century. But second, and more importantly, this global calamity is not a crisis concerning health. It is a crisis about life itself. We have been tempted in recent years to assume the omnipotence of our species. The idea of the Anthropocene places human activity as the dominant influence on the future of life on our planet. Although this newest of geological eras is supposed to underline the harm our species is doing to fragile planetary systems, paradoxically it also asserts our supremacy. Severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) has revealed the hubris of this view. Our species has many reasons to be self-critical about the effects of our way of life on planetary sustainability. But we are only one species among many, and we are certainly not a dominant influence when faced with a virus that can destroy life with such ease and facility.

If this pandemic is a crisis about life itself, what tentative conclusions might we draw from its effects so far on human society? Some clues will be found in Didier Fassin’s Life: A Critical User’s Manual (2018). Fassin studied medicine in Paris before turning to public health and anthropology. His starting point is the awareness we must all have for the unequal lives around us. That observation invites us to reflect on the value we attach to human life. In trying to answer that question, we somehow have to reconcile “life as a fact of nature and as a fact of experience”. We can view COVID-19 as a biological challenge to understand, treat, and prevent. But we should also understand it as a biographical event in the lives of millions of people. Fassin divides his inquiry into inequality into three parts. First, he identifies forms of life, by which he means “ways of being in the world”. The daily insecurities faced by so many of our fellow citizens draw attention to “the predicament of contemporary democracies, incapable of living up to the principles that constitute the foundation of their very existence”. Second, he discusses an ethics of life. He contrasts the rising legitimacy of those who have a biologically defined disease with the declining legitimacy of lives lived in a particular social setting (such as one of poverty). The physical has prevailed over the political. Fassin calls this ethical trend one of “biolegitimacy”—a legitimacy of life defined in biological terms. Life is reduced purely to its physical expression. There is no room for understanding the political conditions within which life exists. There is no possibility to mobilise public sentiment to defend threats to political lives, lives marked by, for example, inequality. SARS-CoV-2 preferentially afflicts those who are more vulnerable, less well rewarded, and more invisible to those with power. Third, Fassin focuses on the politics of life, the government of populations, and the effects of politics on human lives. He is interested in how the actions of political regimes differentially influence human lives and reinforce the unequal worth of some of those lives in society. The “politics of life”, he writes, “are always politics of inequality”.

So what must we say? We must say that it is our task to uncover the biographies of those who have lived and died with COVID-19. It is our task to resist the biologicalisation of this disease and instead to insist on a social and political critique of COVID-19. It is our task to understand what this disease means to the lives of those it has afflicted and to use that understanding not only to change our perspective on the world but also to change the world itself. As Fassin concludes, our “critique does not have to choose between militancy and lucidity”

América Latina y el Caribe ante la pandemia del COVID-19: efectos económicos y sociales

- blog de anegrete

- 2504 lecturas

El COVID-19 llegó en un momento en que la economía mundial se estaba desacelerando. Los niveles de deuda eran históricamente altos, y los salarios y la productividad se habían estancado en muchos países en desarrollo y desarrollados. La crisis sanitaria ha puesto de manifiesto la fragilidad del sistema globalizado y del modelo de desarrollo subyacente.. Después de la crisis, la comunidad mundial tendrá que afrontar el hecho de que la globalización no ha funcionado como se suponía y que es necesario reformarla profundamente.

Este Informe Especial es el primero de una serie que elaborará la Comisión Económica para América Latina y el Caribe (CEPAL) sobre la evolución y los efectos de la pandemia del COVID-19 en América Latina y el Caribe. Sus análisis económicos y sociales se actualizarán a medida que surja información relevante. La Secretaria Ejecutiva de la CEPAL, Alicia Bárcena, dirige la elaboración de este Informe, con el apoyo técnico de la Oficina del Secretario Ejecutivo Adjunto, Mario Cimoli, las Divisiones sustantivas encargadas de los temas que aquí se tratan, y las sedes subregionales y oficinas nacionales de la CEPAL.

Descarga aquí

COVID-19 Compounding Inequalities

- blog de anegrete

- 1726 lecturas

KUALA LUMPUR and SYDNEY, Nov 17 2020 (IPS) - The United Nations’ renamed World Social Report 2020 (WSR 2020) argued that income inequality is rising in most developed countries, and some middle-income countries, including China, the world’s fastest growing economy in recent decades.

Inequality dimensions

While overall inter-country inequalities may have declined owing to the rapid growth of economies like China, India and East Asia, national inequalities have been growing for much of the world’s population, generating resentment.

In 2005, when the focus was on halving poverty, thus ignoring inequality, the UN drew attention to The Inequality Predicament. Secretary-General Kofi Annan warned that growing inequality within and between countries was jeopardizing achievement of the internationally agreed development goals.

“Leave no one behind” has become the rallying cry of the 2030 Agenda for Sustainable Development. Reducing inequality within and among countries is now the tenth of the Sustainable Development Goals (SDGs) adopted in 2015.

Uneven and unequal economic growth over several decades has deepened the divides within and across countries. Thus, growing inequality and exclusion were highlighted in earlier WSRs on Inequality Matters, The Imperative of Inclusive Development and Promoting Inclusion Through Social Protection.

The UNDP’s Human Development Report 2019 (HDR 2019) drew attention to profound education and health inequalities. While disparities in ‘basic capabilities’ (e.g., primary education and life expectancy) are declining, inequalities in ‘enhanced capabilities’ (e.g., higher education) are growing.

Meanwhile, inequalities associated with social characteristics, e.g., ethnicity and gender, have been widening. The January 2020 Oxfam Davos report, Time to Care, highlighted wealth inequalities as the number of billionaires doubled over the last decade to 2,153 billionaires, owning more than the poorest 60% of 4.6 billion.

Drivers of inequalities

WSR 2020 shows that the wealthiest generally increased their income shares during 1990-2015. With large and growing disparities in public social provisioning, prospects for upward social mobility across generations have been declining.

HDR 2019 found that growing inequalities in human development “have little to do with rewarding effort, talent or entrepreneurial risk-taking”, but instead are “driven by factors deeply embedded in societies, economies and political structures”. “Far too often gender, ethnicity or parents’ wealth still determines a person’s place in society”.

Capture of the state by rich elites and commensurate declines in the bargaining power of working people have increased inequality. Real wage rises lag behind productivity growth as executive remuneration sky-rockets and regressive tax trends favour the rich and reduce public provisioning, e.g., healthcare.

Polarising megatrends

HDR 2019 identifies climate change and rapid technological innovation as two megatrends worsening inequalities, with the WSR adding urbanisation and international migration. Technical change not only supports progress, creating more meaningful new jobs, but also displaces workers and increases income inequalities.

Meanwhile, global warming is negatively impacting the lives of many, especially in the world’s poorest countries, worsening inequality. While climate action will cause job losses in carbon-intensive activities, energy saving and renewable energy are likely to increase net employment.

International migration benefits migrants, their countries of origin (due to remittances) and their host countries. But immigrant labour may increase host countries’ inequalities by taking ‘dangerous, dirty, depressed’ and low-skilled work, pushing down wages, especially for all unskilled, while professional migrations are ‘brain drains’, creating new inequalities and worsening existing ones.

COVID-19 and divergence

COVID-19 may worsen divergence among countries owing to its uneven economic impacts due to the different costs and efficacy of containment, relief and recovery measures, influenced by prior health and health care inequalities as well as state capabilities.

Low-income countries have poorer health conditions, weaker health care and social protection systems, as well as less administrative and institutional capacities, including pandemic preparedness and response capabilities. Hence, they are more vulnerable to contagion, while lacking the means to respond effectively.

Rising protectionism and escalating US-China trade tensions have aggravated challenges faced by developing countries which also face declining trade, aid, remittances, export prices and investments. ‘Vaccine nationalism’ will worsen their predicament.

COVID-19 and inequality

The COVID-19 pandemic has highlighted many existing inequalities, and may push 71 million more people into extreme poverty in 2020, the first global rise since 1998, according to the 2020 UN SDGs Report.

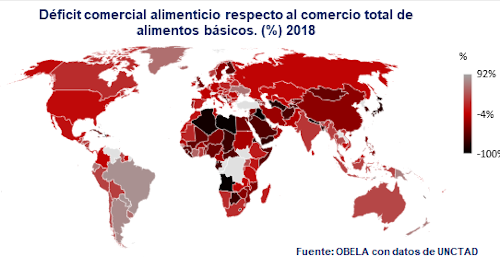

As 55% of the world’s population do not have any social protection, lost incomes mean poverty and hunger for many more. Before COVID-19, 690 million were chronically food insecure, or hungry, while 113 million suffered severe acute food insecurity, or near starvation, mainly due to earlier shocks.

While those in the informal sector typically lack decent working conditions and social protection, most of the workforce do not have the means or ability to work from home during ‘stay in shelter lockdowns’ as most work is not readily done remotely, even by those with digital infrastructure.

Most have struggled to survive. Relief measures have not helped many vulnerable households, while recovery policies have not done much for liquidity-constrained small and micro-enterprises facing problems accessing capital, credit and liquidity, even in normal times.

Meanwhile, many of the world’s billionaires have done “extremely well” during the coronavirus pandemic, growing their already huge fortunes to a record US$10.2 trillion, according to a UBS-PwC report.

Widespread school closures are not only disrupting the education of the young, but also school feeding and child nutrition. Poor access to health services is making matters worse, as already weak health systems are further overstretched.

Unexpected crossroads

UN and Oxfam reports show that growing inequality is not inevitable. The world saw sustained growth with declining inequality in the Golden Age of the 1950s and 1960s. With the neoliberal counter-revolution against development and Keynesian economics, government commitments to development and tackling inequalities have waned.

A 2020 Oxfam report notes, “only one in six countries … were spending enough on health, only a third of the global workforce had adequate social protection, and in more than 100 countries at least one in three workers had no labour protection … As a result, many have faced death and destitution, and inequality is increasing dramatically”.

Governments must adopt bold policies to radically reduce the gap between rich and poor and to avoid a K-shaped recovery. Internationally, improved multilateralism can help check vaccine nationalism, rising jingoist protectionism and debilitating neoliberal trade and investment deals.

COVID-19: A Triple Whammy for Emerging Market and Developing Economies

- blog de anegrete

- 2101 lecturas

Aunque la rápida propagación de la nueva pandemia de coronavirus (COVID-19) en los Estados Unidos y la Unión Europea ha captado la atención del mundo, no hay que perder de vista la pandemia y los problemas de salud y estabilidad económica y financiera que conlleva en el resto del mundo. A medida que la pandemia del COVID-19 avanza a nivel mundial, África y el sur de Asia están siendo testigos de un aumento en el número de nuevos casos últimamente, y estas regiones podrían convertirse pronto en sus próximos epicentros en las próximas semanas.

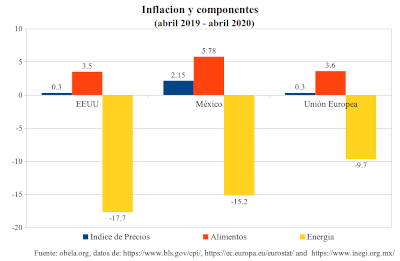

Los mercados emergentes y las economías en desarrollo se enfrentan a un triple golpe: salidas masivas de capital, una repentina interrupción de la actividad económica y el colapso de los precios de los productos básicos, además de una crisis de salud pública causada por COVID-19.

Por consiguiente, los efectos combinados de la pandemia sanitaria, los cierres, la volatilidad financiera y la disminución de los precios de los productos básicos son catastróficos para las EME y socavarían gravemente su capacidad de alcanzar los objetivos de desarrollo sostenible de las Naciones Unidas.

Descarga aquí

Coronavirus Leads to Nosedive in Remittances in Latin America

- blog de anegrete

- 2053 lecturas

CARACAS, May 18 2020 (IPS) - Remittances that support millions of households in Latin America and the Caribbean have plunged as family members lose jobs and income in their host countries, with entire families sliding back into poverty, as a result of the COVID-19 health crisis and global economic recession.

The region will receive a projected 77.5 billion dollars in remittances this year, 19.3 percent less than the 96 billion dollars it received in 2019, according to provisional forecasts by the World Bank.

The damage “can be understood from the angle of consumption. Six million households, of the 30 million that receive remittances, will not have them this year, and another eight million will lose at least one month of that income,” expert Manuel Orozco told IPS from Washington, D.C.

Remittances in the region average 212 dollars per month, according to studies by the Inter-American Development Bank (IDB).

Remittances “represent 50 percent of the total income of the households that receive money from family members abroad, and increase their savings capacity to more than double that of the average population,” said Orozco, who heads the migration, remittances and development programme at the Inter-American Dialogue organisation.

“The projected fall, which would be the sharpest decline in recent history, is largely due to a fall in the wages and employment of migrant workers, who tend to be more vulnerable to loss of employment and wages during an economic crisis in a host country,” the World Bank stated in a report.

The cause of this was the shutdown of entire segments of economic activity in an attempt to curb the spread of the COVID-19 virus, which deprived migrants of their sources of employment and income, thus undermining their ability to send money back home to their families.

This is a global phenomenon, with remittances falling by at least 19.7 percent to 445 billion dollars in low- and middle-income countries as a whole: dropping by 23 percent in sub-Saharan Africa, 22 percent in South Asia, 19.6 percent in the Middle East and North Africa, and 13 percent in East Asia and the Pacific.

Remittances “are a vital source of income for developing countries,” World Bank Group President David Malpass said Apr. 22, noting their role in alleviating poverty, improving nutrition, increasing spending on education and reducing child labour in disadvantaged households.

Alicia Bárcena, executive secretary of the Economic Commission for Latin America and the Caribbean (ECLAC), listed the drop in remittances among the factors that will depress the region’s economy to an unprecedented level, -5.3 percent, with the risk of poverty climbing from 186 million to 214 million inhabitants: 33 percent of the total population.

An empty money transfer office in Las Vegas, Nevada, which is usually packed with migrants sending remittances home from the U.S. to their families in Central America. The city, dedicated to leisure and tourism, has been paralysed by the COVID-19 pandemic, leaving thousands of migrant workers without employment or income. CREDIT: Western Union - Remittances that support millions of households in Latin America and the Caribbean have plunged as family members lose jobs and income in their host countries

Anxiety from the north

The countries that will be hardest hit are those of Central America and Haiti, according to Bárcena. Remittances make up between 30 and 39 percent of Haiti’s gross domestic product (GDP), and last year accounted for 21.8 percent of Honduras’ GDP, 21.2 percent of El Salvador’s and 13.8 percent of Guatemala’s.

“We’re talking about fragile states, with collapsed health systems, weak or corrupt governments, and budgets that were already insufficient to meet people’s needs and are worse off now,” Victoria Gass of the U.S. division of Oxfam’s anti-poverty coalition told IPS from New York.

Orozco stressed that it will affect the consumption capacity of 20 percent of Central Americans, who will be forced to use their savings, on average a quarter of all remittances, for immediate expenses such as buying food and medicine.

In El Salvador, for example, Gabriela Pleitez, 35, who lives in the capital, no longer receives the 200 dollars a month sent to her by her mother, a dental assistant, and her brother, a taxi driver, who live in Los Angeles, California and found themselves suddenly unemployed.

Gabriela completed the 400 dollars she needed to get by with unsteady work as a real estate agent or by selling clothes and beauty products. Now she takes in some money as an assistant at a stand that sells traditional foods.

“I don’t buy bread anymore, and I’m eating less. If you manage to get 10 dollars you have to think carefully what to spend it on. If I don’t pay the water bill, they will cut it off. My landlord won’t charge me rent for three months, in accordance with a government decree, but then he will want me to leave,” she told IPS.

Another Salvadoran, Rosa Ramírez, a 56-year-old mother and grandmother still in charge of an adult daughter and four children, said the pandemic dealt her small flower arrangement business a death blow. “The situation was difficult before, and now, with homes and businesses closed, I’m out of work,” the resident of Zacatecoluca, in the central department of La Paz, told IPS.

Her lifeline is her son Luis, 27, who found a job in 2018 as a carpenter in Stafford, Virginia, in the U.S. southeast, after fleeing from gangs who demanded he make payments to keep them from attacking his then three-year-old daughter.

Luis used to send her between 350 and 400 dollars a month “to pay bills, the rent, and medicine, because I’ve had high blood pressure for years and I can’t go without my medicine,” Rosa said. But now her son has only sent her half that because “he is working fewer hours, one day he gets a job and the next he doesn’t.”

Rosa’s daughter received a temporary 300 dollar aid package provided by the government for the most vulnerable, and was able to cover basic expenses. But Rosa is now anxious about how she will make ends meet. Her daughter, Gabriela, would like to emigrate to the United States, but she has been told that the legal process could take eight years.

Another hard-hit country is Mexico, where 42 percent of the population of 130 million lives in poverty. In 2019, 36 billion dollars in remittances came in, mostly from the 37 million people of Mexican origin living in the United States.

Seven million households received remittances in 2019, but this year 1.7 million of those households will not receive them, Orozco calculated, due to the wave of unemployment that is hitting the U.S.

Intra-regional migration in the South

South America has a more even spread of migration that provides it with remittances, between North America, Spain and other European countries, and the sub-region itself, greatly increased by the millions of Venezuelans who fled to neighbouring countries in the last six years due to the economic, political and humanitarian calamity in their country.

This is the case, for example, of 26-year-old Laura (who preferred not to give her last name), who works in a veterinary clinic in Lima, “which has practically been left without clients due to the lockdown ordered by the Peruvian government. My husband, who used to do various jobs, is not bringing in an income either,” she told IPS from the Peruvian capital.

Laura regularly sent 100 dollars a month to her mother, a widow raising two teenage children on the meager salary (equivalent to five dollars a month) of a school teacher in Barquisimeto, a city in central-western Venezuela.

With each remittance, her mother “could buy some medicine, some meat, milk and eggs to complete the CLAP (the acronym for the bag of basic foodstuffs that the government delivers monthly at subsidised prices to poor families), but now I can’t send her almost anything, we’re just trying to scrape by in Lima,” said Laura.

Of the Venezuelans working in Peru, 46 percent were street vendors, 15 percent were employed in shops and six percent worked in restaurants – activities that have all faced restrictions in the COVID-19 pandemic, according to research by Cécile Blouin of the Pontifical Catholic University in Lima.

In the last five years, 1.6 million Venezuelans have migrated to Colombia, 880,000 to Peru, 385,000 to Ecuador, 370,000 to Chile, 250,000 to Brazil and 145,000 to Argentina, according to a platform of United Nations agencies and NGOs monitoring the phenomenon.

The Venezuelan diaspora was added to more traditional migration flows, such as that of Paraguayans in Argentina: 550,000 migrants who sent home some 70 million dollars in 2019, a figure that was already declining due to exchange controls in Buenos Aires.

One third of the 1.3 billion dollars that Bolivia received in remittances in 2019 came from Bolivian migrants in Argentina, Brazil and Chile, but the figure has dropped since March with the measures put in place in the attempt to contain the spread of COVID-19.

In Peru, which has three million citizens living abroad, a quarter of the 3.3 billion dollars the country received in remittances in 2019 came from the 350,000 Peruvians living in Argentina and the 250,000 in Chile.

Until this global upheaval, remittances were counter-cyclical: workers sent more money to their families when their home countries were experiencing crisis and hardship, which this time they have not been able to do because the pandemic and recession have affected all countries.

But there is some hope for the future. According to the International Monetary Fund, after falling -3.0 percent in 2020, the world economy will grow 5.8 percent in 2021 (Latin America 3.4 percent) and remittances will also increase at a similar rate. In low- and middle-income countries they will total 470 billion dollars.

But for millions of Latin American families, like those of Gabriela and Rosa in El Salvador or Laura in Venezuela, that’s too long a wait.

Covid-19 en la economía mundial: impulso y retroceso

- blog de anegrete

- 2641 lecturas

Esta nota pretende contrastar lo que la pandemia COVID-19 ha significado en términos económicos y sociales y el patrón que puede dar para un cambio en las relaciones económicas. La adopción de nuevas tecnologías en el contexto del proteccionismo y las políticas nacionalistas ha cobrado impulso. Las diferentes realidades a las que se enfrentan los países y sectores de bajos y altos ingresos dan lugar a respuestas y consecuencias diferentes. Las nuevas proyecciones en las que todas las economías se contraen, mientras China se expande, serán una fuente de conflicto entre Oriente y Occidente. El hecho de que quede una economía que tire del crecimiento económico mundial indica que las relaciones económicas internacionales se dirigirán hacia el Este.

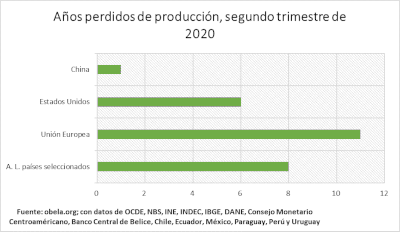

Como se anticipó (http://www.obela.org/analisis/covid19-el-comienzo-del-efecto-domino) las previsiones de crecimiento de la economía mundial a principios de año eran optimistas. A finales de junio, el crecimiento mundial tiene una proyección anual de -4.9% (FMI) -5.2% (Banco Mundial) y -6% (OCDE). En el peor de los casos, estas dos últimas organizaciones prevén contracciones de -8 y -7.7%, respectivamente. El Fondo Monetario Internacional prevé que los Estados Unidos se contraigan en un -8.0% mientras que China observará un crecimiento del 1.0%. La Zona Euro y América Latina se contraerán en -10.2 y -9.4%, respectivamente. Según el presidente del Banco Mundial, Malpass, el año 2020 es el peor en términos de crecimiento desde la crisis de 1929 y posiblemente desde la larga depresión de 1872.

El impacto en la dinámica de crecimiento ha sido mundial. Sin embargo, la experiencia de la pandemia en las economías emergentes dista mucho de la de las economías avanzadas. La cuestión es por qué los gobiernos con mayor capacidad fiscal y monetaria para aplicar políticas anticíclicas tienen resultados de crecimiento similares. Una hipótesis es que se enfrentan a choques simultáneos de oferta y demanda que anulan los esfuerzos expansionistas de los gobiernos.

La diferencia en la estructura del mercado laboral entre las economías avanzadas y las emergentes es evidente. Las economías desarrolladas tienen mercados de trabajo formales con un margen informal más reducido. Las economías emergentes tienen altos niveles de informalidad que están estrictamente relacionados con mercados legales pequeños y precarios. Los altos niveles de informalidad están estrechamente relacionados con la baja capacidad tributaria de los gobiernos de esos países. Esta situación genera una serie de problemas, como la falta de acceso a la atención médica universal o al seguro de desempleo. Son inexistentes en las economías emergentes que, en las condiciones actuales, resultan ser un factor anticíclico fundamental para contener la pérdida de ingresos derivada de los efectos nocivos de la pandemia.

El patrón de consumo es otro aspecto en el que existen marcadas diferencias, tanto en términos de poder adquisitivo como en la forma en que se realizan las compras. Los sectores de mayores ingresos observan una explosión en el uso de las compras en línea, incluido el supermercado, que permite a los individuos permanecer confinados. El instrumento de pago es la tarjeta de crédito. Los sectores de menores ingresos compran en mercados, que son polos de contagio en el mundo, y pagan en efectivo. Los sectores de altos ingresos viajan en vehículos privado, mientras que la población de bajos ingresos viaja en transporte público, que es ahora otro polo de infección.

Mientras que en las economías avanzadas la aplicación de nuevas tecnologías permite la transición a nuevas formas de consumo, los ingresos de subsistencia son una característica dominante en las economías emergentes. Ante la falta de actividades económicas, la pérdida de ingresos y de empleo, no hay más remedio que buscar ingresos de cualquier manera, con exposición a la pandemia. En cuanto a la producción y los servicios, se ha reforzado la robotización, lo que permite el distanciamiento social. Este cambio tecnológico se produce en mayor medida en las economías avanzadas, pero se producirá más pronto que tarde en los países emergentes, lo que agravará el desempleo oficial.

La pandemia está empezando a generar un retroceso en cuanto a los Objetivos de Desarrollo Sostenible (ODM). Las proyecciones apuntan a un aumento de la pobreza, la desigualdad empeorará y las restricciones al uso de energía de combustibles fósiles disminuirán para fomentar el crecimiento económico a expensas del medio ambiente y el cambio climático. Los retos son generar un renacimiento económico que promueva el empleo, la agricultura sostenible, la reducción de las cadenas de valor mundiales, el aumento del uso de la energía renovable y el descubrimiento de una vacuna y un tratamiento que sean universales y gratuitos.

Descarga / English version

Covid-19 in the world economy: momentum and retreat

- blog de anegrete

- 2049 lecturas

This note aims to contrast what the COVID-19 pandemic has meant in economic and social terms and the pattern it may give for a change in economic relations. The adoption of new technologies in the context of protectionism and nationalist policies has gained momentum. The different realities faced by low- and high-income countries and sectors lead to different responses and consequences. The new projections where all economies contract while China expands will be a source of conflict between East and West. The fact that there is one remaining economy that pulls the world economic growth indicates that international economic relations will veer east.

As anticipated (http://www.obela.org/en-analisis/covid19-the-beginning-of-the-domino-effect), growth forecasts for the world economy at the beginning of the year were optimistic. At the end of June, the world output has a yearly projection of -4.9% (IMF) -5.2% (World Bank) and -6% (OECD). In worst-case scenarios, the latter two organizations foresee contractions of -8 and -7.7%, respectively. The International Monetary Fund anticipates that the United States will contract by -8.0% while China will observe a growth of 1.0%. The Euro Zone and Latin America are to contract by -10.2 and -9.4%, respectively. According to World Bank president Malpass, the year 2020 is the worst in terms of growth since the 1929 crisis and possibly since the 1872 Long Depression.

The impact on growth dynamics has been global. The experience of the pandemic in emerging economies, however, is far from that of advanced economies. The question is why governments with higher fiscal and monetary capacity to conduct countercyclical policies have similar growth results. One hypothesis is that they face simultaneous supply and demand shocks that cancel out the expansionary efforts of governments.

The difference in the structure of the labour market between advanced and emerging economies is evident. Developed economies have formal labour markets with a smaller informal edge. Emerging economies have high levels of informality that are strictly related to small and precarious legal markets. High levels of informality are closely related to the low taxing capacity of the governments of these countries. This situation generates a series of problems, such as the lack of access to universal health care or unemployment insurance. They are non-existent in emerging economies, which, under present conditions, prove to be a fundamental countercyclical factor in containing the loss of income resulting from the harmful effects of the pandemic.

The pattern of consumption is another aspect where there are marked differences, in terms of purchasing power and in the way purchases happen. Higher-income sectors observe an explosion in the use of online shopping, including the supermarket, which allows individuals to remain confined. The payment instrument is the credit card. Lower-income sectors buy in markets, that are poles of contagion in the world, and they pay in cash. High-income segments travel privately, while the low-income population travels by public transport, which is now another pole of infection.

While in advanced economies, the implementation of new technologies allows the transition to new forms of consumption, subsistence income is a dominant feature in emerging economies. In the face of the lack of economic activities, loss of income and employment, there is no choice but to seek revenue in any way with exposure to the pandemic. For production and services, there is a strengthening of robotization, which allows for social distancing. This technological change occurs to a greater extent in advanced economies, but will happen sooner rather than later in emerging countries, aggravating formal unemployment.

The pandemic is beginning to generate a setback in terms of the Sustainable Development Goals (SDGs). Projections are for an increase in poverty, inequality will worsen, and restrictions on fossil fuel energy use will diminish to foster economic growth at the expense of the environment and climate change. The challenges are to generate an economic revival that promotes employment, sustainable agriculture, the reduction of global value chains, the increased use of renewable energy, and the discovery of a vaccine and treatment that are universal and free of charge.

Download

Covid-19: el comienzo del efecto dominó

- blog de anegrete

- 5728 lecturas

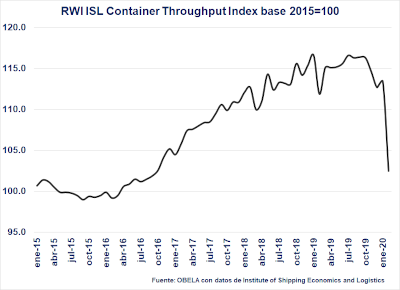

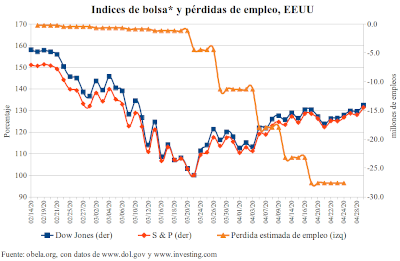

Los efectos del COVID-19 en la economía real se comienzan a materializar alrededor del mundo. Ya en la segunda mitad de marzo se dieron los primero síntomas del deterioro de la confianza e incertidumbre en la economía cuando en el sector financiero los índices de bolsa de los principales países cayeron a mínimos durante el año. En esta nota se presentan indicadores tanto en el sector laboral como en la industria y servicios en EEUU y algunas de las economías del G20 para los cuales hay datos disponibles. La situación que inevitablemente se verá para la mayoría de los países en el mundo será: caída del producto, desempleo a pesar de los esfuerzos de las autoridades económicas. Esta vez con un impacto generalizado para todos los países, sectores y con un riesgo directo para el ser humano.

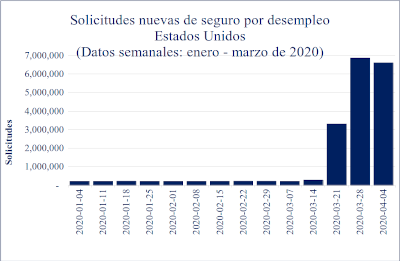

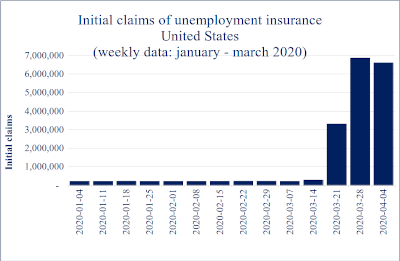

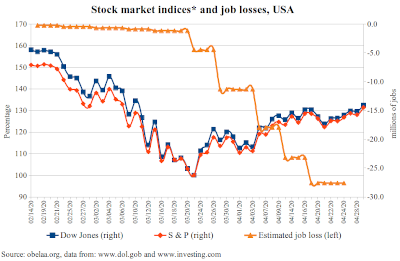

En EEUU el indicador de las Solicitudes Nuevas de Seguro por Desempleo (SND) que proporciona el Departamento del Trabajo del EEUU con una periodicidad semanal nos deja ver las consecuencias en su economía por el paro de actividades para tratar de contener los efectos del COVID-19. En la siguiente gráfica se muestran los datos para lo que va del año. Desde la segunda semana de marzo hubo un incremento en las SND aunque no estaba lejos de la media del año de 218,000. Fue hasta la tercera semana de marzo que hubo un salto en las SND a 3,307,000; en la cuarta semana 6,867,000 y el último dato disponible fue de 6,606,0001. En las últimas 4 semanas las SND suman 17 millones, de ese tamaño es el impacto inicial en el mercado laboral y el número de personas que han quedado desempleadas. Los principales estados que solicitan un seguro por desempleo son: California, Nueva York, Michigan, Florida y Georgia, los cuales están entre los que más casos confirmados de contagio hay en EEUU.

El 3 de abril la Oficina de Estadísticas Laborales (BLS por sus siglas en inglés) publicó el informe de la situación laboral2 para el mes de marzo en el cual se estima que la tasa de desempleo que pasó de 3.5 a 4.4% de febrero a marzo. El número de personas desempleadas pasó de 1.4 a 7.1 millones, aunque con las cifras que ofrece el SND se puede afirmar que este número sin duda crecerá. El sector servicios es el más afectado, principalmente en actividades recreativas, servicios de comida y bares. En menor medida se vieron afectados: servicios profesionales y de negocios; comercio al por menor y la construcción. Tomando en cuenta la velocidad con la cual han parado actividades, la probable quiebra de negocios y empresas, la recuperación de los empleos perdidos difícilmente se logrará alcanzar en su totalidad.

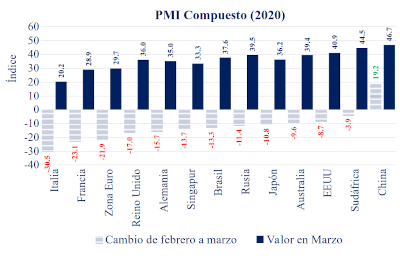

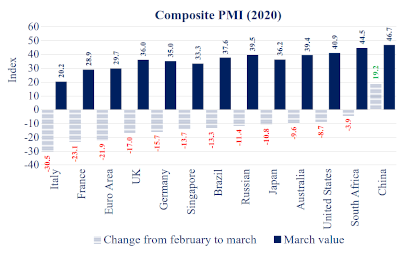

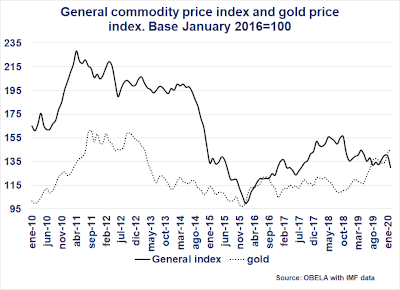

Otro indicador que está disponible para una serie de economías es el Índice de Gerentes de Compras (PMI por sus siglas en inglés) que publica el IHS Markit. Dicho índice nos indica la situación de diversos sectores de forma adelantada a indicadores macroeconómicos tradicionales. Existen tres niveles principales para el PMI: el manufacturero, el de servicios y el compuesto. En la siguiente gráfica se muestra el PMI compuesto para el mes de marzo, así como la variación que tuvo el índice del mes de febrero a marzo del presente año para una serie de economías. Cabe mencionar que un nivel por debajo del 50 representa una contracción, el cual es el caso para todas las economías presentadas. Italia, Francia y Reino Unido son las que presentaron las mayores caídas en este indicador. Al interior, el PMI manufacturero tuvo caídas, aunque estas fueron relativamente menores a las presentadas en el PMI de servicios en todas las economías.

Se observa que el único país con un mejoramiento del PMI compuesto en marzo fue China el cual llegó a un nivel de 27.5 en febrero y tuvo una recuperación en marzo que alcanzó un nivel de 46.7, es decir, aunque tuvo una mejora con respecto al mes previo, sigue en un terreno de contractivo. El efecto dominó ya comenzó y ahora la situación que se dio en febrero en China se presenta en el resto de las economías en marzo. Al respecto se debe tener en cuenta: el impacto en las cadenas globales de valor, por un lado, y el propio efecto del cierre de negocios y la paralización de la actividad económica por la propagación del COVID-19 el cual explica el impacto en el PMI en el sector servicios, que es peor que el de la manufactura.

Si se toma como referencia el caso de los EEUU y las consecuencias en el sector laboral y desempleo que ya se observan en dicho país, se puede inferir una situación similar para el resto del mundo en los próximos meses cuando se den a conocer cifras oficiales. La velocidad de la propagación del COVID-19 ha tenido efectos desde el sector financiero de los cuales hemos sido testigos y ahora vemos en el sector real. La primera ficha cayó hace unos meses. El efecto, alcance y horizonte de normalización de toda actividad parecen estar lejos y son inciertos. La diferencia de la crisis del COVID-19 con las vividas en las últimas décadas es el grado de penetración, pues esta vez se abarcan todos los sectores y niveles socioeconómicos alrededor del mundo. Mientras no se encuentre una cura, estamos ante una crisis que puede tener consecuencias no vistas desde la Gran Depresión de 1929 según declaraciones de la directora del FMI.

1 https://www.dol.gov/ui/data.pdf

2 https://www.bls.gov/news.release/pdf/empsit.pdf

Descarga / english version

Covid-19: the beginning of the domino effect

- blog de anegrete

- 3274 lecturas

The effects of COVID-19 on the real economy are beginning to materialize around the world. Starting in the second half of March, the first signs of the deterioration of confidence and uncertainty occurred with the world's major stock market indices falling to multi-year lows; for example, the Dow Jones dropped to the 2016 level, the Frankfurt DAX to 2012, and so on. This note presents labour, industry, and services sector indicators for the G7 and BRICS economies. The same situation is reflected in the rest of the world, with a drop in output and international trade and massive unemployment despite the efforts of economic authorities to inject liquidity. The massive injections of cash by the central banks of the US, UK, European Union, and Japan are helping banks to invest that money in the stock markets and thus try to stabilise them. Meanwhile, the Chinese stock market remains stable.

The weekly Unemployment Insurance Claims (SND) indicator from the US Department of Labor shows that historically the levels are around 300,000 unemployed people with insurance. This figure dropped to 218,000 during 2019 and ended in the second week of March when there was a slight increase. In the third week of March 2020, unemployment insurance claims increased 15-fold to 3,307,000; in the fourth week, 6,867,000; and the last available data from the first week of April was 6,606,0001; with a record 17 million people unemployed in three weeks. California, New York, Michigan, Florida, and Georgia are the states with the most confirmed cases and the same ones with the most unemployment insurance claims. As the number of states with higher case volumes expands, those claims will grow by business closures.

The service sector is the most affected, mainly in recreational activities and in food and bar services. To a lesser extent, professional and business services are affected, as well as retail trade and construction. Given the speed with which activities have come to a standstill and the likely bankruptcy of small and medium-sized businesses and enterprises, there is no prompt recovery of the jobs lost. It will be a slow recovery giving the economic crisis a U-shape or, in the worst-case, L-scenario. It will not have a V-shape, with a rebound, unlike 2009. The difference between the U and L is the period the economy will remain stagnant. During that time, new economic activities take place with a complete shift of the energy matrix from oil to clean energy.

The Purchasing Managers' Index (PMI) published by the IHS Markit indicates the expectation of the situation in various economic sectors ahead of traditional macroeconomic indicators. There are three primary levels: manufacturing, services, and composite. The graph shows the composite PMI of the G7 countries plus the BRICS, for March, and the variation from February to March of this year. A level below 50 represents a contraction. Evidence shows it is the case for all economies presented, with Italy, France, and the United Kingdom observing the most significant drops. The fall in the services PMI is more significant than those shown in the manufacturing PMI.

The only country with a V-shaped economic crisis was China. It bounced back from 27.5 in February to 46.7 in March. The global domino effect began in February in China and spread to the rest in March. What precipitated the domino effect was the global value chains that have manufacturing in China as their starting point, closed in January and February. Then there is the powerful effect of the spread of COVID-19. The closure of businesses and the paralysis of economic activity in the world explains the worse impact on the PMI of the service sector.

The difference between the COVID-19 crisis and that of 2008 is the degree of penetration since it covers all sectors and socio-economic levels around the world. In a context of a recessionary world economy that was pointing downwards, productive paralysis unleashed. The dangerous thing is that until there is a cure and it becomes massive, the crisis may have consequences not seen since the Great Depression of 1929, according to statements by the managing director of the IMF. Meanwhile, with the epidemic under control, China recovers through internal value chains with a strong role of the state in the economy.

1 https://www.dol.gov/ui/data.pdf

Download

Dimensionar los efectosdel COVID-19 para pensaren la reactivación

- blog de anegrete

- 2263 lecturas

La pandemia del COVID-19 impactó América Latina y el Caribe en un momento de debilidad de su economía y de vulnerabilidad macroeconómica. En el decenio posterior a la crisis financiera mundial (2010-2019), la tasa de crecimiento del PIB regional disminuyó del 6% al 0,2%. A medida que la pandemia se propaga en la región, su caracterización como crisis sanitaria, económica y social es cada vez más evidente.

El objetivo de este segundo Informe Especial de la Comisión Económica para América Latina y el Caribe (CEPAL) es dimensionar los efectos económicos de la pandemia en el corto y mediano plazo. Para el corto plazo, es decir en el curso de 2020, se presentan estimaciones de la dinámica de la producción y el empleo con base en la información disponible al 17 de abril de 2020, que abarca todas las subregiones de América Latina y el Caribe y muchas de sus economías.

Dimensionar la caída de la actividad económica permite comenzar a determinar la magnitud del esfuerzo para un regreso a la normalidad. Pero ese regreso no será y no debe ser una vuelta a la situación existente antes de la pandemia. La visión de mediano plazo con la que concluye este Informe ilustra los cambios estructurales en la organización de la actividad productiva que están en proceso y que se intensificarán.

Descargar aquí

El COVID-19 y el mundo del trabajo

- blog de anegrete

- 2005 lecturas

El Observatorio de la Organización Internacional del Trabajo estima, en este infome, que la pandemia ocasionada por el COVID-19 se ha acelerado aún más en términos de intensidad y ampliación de su alcance a nivel mundial. Las medidas de paralización total o parcial ya afectan a casi 2,700 millones de trabajadores, es decir: a alrededor del 81% de la fuerza de trabajo mundial.

En las últimas dos semanas, la pandemia ocasionada por el COVID-19 se ha intensificado y ampliado a escala mundial; las repercusiones en la salud pública son enormes, y las economías y los mercados de trabajo están sufriendo perturbaciones sin precedentes. Es la peor crisis mundial desde la Segunda Guerra Mundial. Desde la evaluación preliminar de la OIT del 18 de marzo, las infecciones mundiales por el COVID-19 se han multiplicado por más de seis, y el 3 de abril de 2020 el recuento se sitúa en 1,030,628; otras 47,600 personas han perdido la vida, con lo que el total de fallecimientos asciende a 54,137 . A fin de evitar resultados catastróficos para los sistemas nacionales de salud y reducir al mínimo la pérdida de vidas, muchos países han comenzado a aplicar medidas de distanciación social para así frenar la propagación del virus.

En la situación actual, las empresas de diversos sectores económicos, en especial las empresas más pequeñas, se enfrentan a pérdidas catastróficas que amenazan su funcionamiento y solvencia, y millones de trabajadores están expuestos a la pérdida de ingresos y al despido.

El coronavirus prueba que la sociedad existe

- blog de anegrete

- 1973 lecturas

Tuvo que llegar una terrible pandemia para decirnos que la sociedad existe. Que somos seres humanos, de carne y hueso, y que nos necesitamos los unos a los otros. El coronavirus nos exige amor y solidaridad. Hoy rechazamos los comportamientos egoístas, los que especulan con el alcohol gel y las mascarillas de protección. Y, al mismo tiempo, aplaudimos la dedicación incansable de los trabajadores de la salud que, más allá de su vida personal, se entregan por entero en ayuda del próximo.

El coronavirus ha tenido el mérito de despertarnos de esa pesadilla que instaló la Primera Ministra de Gran Bretaña, Margaret Thatcher, cuando afirmaba, en pleno auge de su carrera política: “La sociedad no existe, solo existen hombres y mujeres individuales”.

En 1980, la Sra. Thatcher, y luego Ronald Reagan, inspirados en los economistas Hayek y Milton Friedman, impulsaron el modelo del sálvese quien pueda en sus países -el neoliberalismo-, que se extendió al mundo entero. Incluso antes, con Pinochet, el modelo neoliberal se había impuesto en Chile a sangre y fuego y, posteriormente, ya en democracia, fue asumido plenamente por la mayoría de los políticos y economistas chilenos.

En los últimos 40 años el neoliberalismo ha vivido su mayor gloria, muy especialmente en nuestro país. Ha convertido a los seres humanos en individuos egoístas, que luchan unos contra los otros. No vivimos una economía de mercado, sino una sociedad de mercado, en que los individuos, al igual que las empresas, compiten salvajemente para enriquecerse, consumir y/o alcanzar posiciones de poder.

Negar la sociedad, dudar que necesitamos a quienes nos rodean es negar que somos sujetos sociales, parte de una comunidad con la que compartimos, con la que sufrimos, con la que vivimos. Y, precisamente, el coronavirus lo ha puesto en evidencia.

Hoy día el miedo al virus recorre pobres y ricos, porque la muralla que nos separaba ha sido derribada por la pandemia. Y, para enfrentar el virus no hay más alternativa que enfrentarlo unidos. Aunque estamos lejos de reducir las diferencias de clases, se requiere solidaridad y reglas comunes de comportamiento, para que las personas puedan sobrevivir.

El coronavirus entrega también una lección a clase política y a ese Estado mínimo que se construyó en Chile y el mundo en las últimas décadas. La vida y no el crecimiento económico siempre debieran estar en el centro de nuestras preocupaciones. Por ello, aunque existe crecimiento, las desigualdades y abusos ponen en cuestión la fragilidad de la sociedad y no sólo en salud, sino en protección social, en general. En efecto, el coronavirus nos enferma a todos por igual y por tanto resulta inútil un sistema de salud que diferencia entre pobres y ricos.

En cierta forma, el coronavirus nos ha igualado un poco y hace justicia frente a las injusticias del modelo económico dominante. Ahí están las iniciativas populares que fortalecen nuestra resistencia ante esta la pandemia. Allí está el aplauso diario a quienes hoy están en la primera línea desafiando la infección y el agotamiento. Están también las iniciativas de apoyo mutuo entre vecinos, especialmente aquellas que tratan de ayudar a las personas mayores. La solidaridad ha crecido, porque frente a la tardanza de ciertas decisiones gubernamentales, la ciudadanía es la que toma decisiones en los barrios y municipios

Con la pandemia, y antes con la rebelión social del 18 de octubre, ha quedado en evidencia en nuestro país que jóvenes, mujeres y hombres se sienten parte de un colectivo más amplio, se piensan como seres sociales y políticos, dispuesto a la colaboración. Se sienten parte de la sociedad. Rechazan el individualismo que promueven el Estado mínimo y el modelo económico en que empresas, bancos y bolsas de comercio, apoyados por los medios de comunicación agobian nuestra existencia con la competencia y el dinero.

Son tiempos de solidaridad. Tiempos para entender lo injusto de haber intentado precarizar la sanidad pública en nuestro país y para pensar también la injusticia que significa una educación para ricos y pobres, así como la urgencia de terminar con las pensiones miserables de nuestros ancianos, los más sufrientes con el coronavirus. Vivimos tiempos que muestran que no somos, como dijo la Thatcher, sólo hombres y mujeres aislados. El coronavirus es la prueba más evidente que la sociedad existe. No sólo ahora, sino ahora y siempre.

El desafío social en tiempos del COVID-19

- blog de anegrete

- 2241 lecturas

Este Informe Especial es el tercero de una serie que elaborará la Comisión Económica para América Latina y el Caribe (CEPAL) sobre la evolución y los efectos de la pandemia del COVID-19 en América Latina y el Caribe.

En esta edición se actualizan las cifras macroeconómicas derivadas de la crisis sanitaria global y se miden sus diferentes impactos socioeconómicos que evidencian un aumento de la pobreza, la pobreza extrema y reflejan la matriz de la desigualdad en la región.

Ante las grandes brechas históricas que la pandemia ha agravado, la CEPAL reitera que es el momento de implementar políticas universales, redistributivas y solidarias con enfoque de derechos, para no dejar a nadie atrás.

Las respuestas en materia de protección social deben articular las medidas de corto plazo necesarias para atender las manifestaciones más agudas de la emergencia (garantía universal de ingresos, acceso universal a las pruebas y a la atención médica, a los servicios básicos y a la vivienda, a la alimentación adecuada y a la educación), con otras de mediano y largo plazo (salud universal, estrategias de inclusión laboral en el período de la recuperación), orientadas a garantizar el ejercicio de los derechos de las personas mediante el fortalecimiento del Estado de bienestar y la provisión universal de protección social.

Descarga aquí

El gobierno de los EE.UU. debe eliminar de inmediato las sanciones económicas para evitar causar más muertes por pandemia, dicen economistas

- blog de anegrete

- 2183 lecturas

WASHINGTON, DC ― El gobierno de los Estados Unidos debe eliminar de inmediato las sanciones económicas contra Irán, Cuba, Venezuela y otros países para evitar muertes innecesarias y una propagación más amplia de la pandemia, dijo el economista Jeffrey Sachs, profesor y director del Centro para el Desarrollo Sostenible de la Universidad de Columbia. Si bien las sanciones ya causan decenas de miles de muertes innecesarias, el número de víctimas mortales durante la nueva pandemia de coronavirus empeorará en países donde las importaciones de medicamentos y equipamiento médico, y el mantenimiento del agua, el saneamiento y la infraestructura de atención médica estén restringidos debido al impacto de las sanciones estadounidenses. Estas restricciones también harán que sea más difícil para las autoridades de salud controlar la propagación de la enfermedad dentro de sus países.

“La administración Trump está utilizando sanciones contra Irán y Venezuela para presionar a esos gobiernos al inducir un sufrimiento generalizado”, dijo Sachs. “Esta política es desmesurada y viola flagrantemente el derecho internacional. Lo que es peor, ahora está alimentando la epidemia de coronavirus. Es imprescindible que Estados Unidos elimine estas sanciones inmorales e ilegales para permitir que Irán y Venezuela enfrenten la epidemia de la manera más efectiva y rápida posible”.

Las paralizantes sanciones económicas contra Venezuela e Irán, y una serie de sanciones dirigidas a Corea del Norte, fueron impuestas unilateralmente por el presidente Trump, gracias a los amplios poderes que tiene el presidente de EE.UU. para imponer sanciones en virtud de la Ley de Poderes Económicos de Emergencia Internacional y la Ley de Emergencias Nacionales. La congresista Ilhan Omar (Demócrata por Minnesota) presentó recientemente un proyecto de ley que reformaría estas dos leyes para restablecer el control y la supervisión del Congreso sobre el poder del presidente para imponer sanciones.

“No hay duda de que la capacidad de Irán para responder al nuevo coronavirus se ha visto obstaculizada por las sanciones económicas de la administración Trump, y en consecuencia la cifra de muertos es probablemente mucho mayor de lo que hubiera sido en condiciones normales”, dijo Mark Weisbrot, codirector del Centro de Investigación en Economía y Política (CEPR). “Tampoco cabe duda de que las sanciones han afectado la capacidad de Irán para contener el brote, lo que a su vez provocó más infecciones y posiblemente la propagación del virus más allá de las fronteras de Irán”.

El economista Francisco Rodríguez, un destacado experto sobre la economía venezolana, dijo: “Independientemente de si uno está de acuerdo o no con la justificación inicial de las sanciones económicas, está claro que perjudican gravemente la capacidad de los países afectados para responder a la pandemia global. Esto tiene graves consecuencias sobre la vida de sus ciudadanos y significa un importante riesgo para la salud global”.

Incluso antes de que el coronavirus comenzara a extenderse, los Centros para el Control y la Prevención de Enfermedades (CDC) de EE.UU. advirtieron que Venezuela estaba experimentando graves brotes de enfermedades infecciosas y señalaron que había habido “un colapso de la infraestructura médica en Venezuela”, y que “la escasez de agua y alimentos, electricidad, medicinas y suministros médicos contribuyó a una creciente crisis humanitaria”.

“Los estadounidenses son las personas más generosas del mundo en donaciones per cápita a la caridad. En medio de una pandemia mundial, creo que la mayoría de los estadounidenses quieren dejar a un lado la política y hacer todo lo posible para garantizar que todos, donde sea que vivan en este planeta, tengan la mejor oportunidad posible de obtener alimentos, agua limpia, buena higiene y atención médica”, dijo Linda Bilmes, profesoral principal “Daniel Patrick Moynihan” de Políticas Públicas de la Universidad de Harvard. “Eliminar las sanciones es lo correcto por razones humanitarias, y también es lo mejor desde la perspectiva de nuestros propios intereses”.