The very high inflation of 2022 led the US central banks, the FED, and the ECB of the EU to raise their interest rates. It was followed by all central banks in the rest of the Western world to keep exchange rates stable and to contain inflation. In China and some Asian countries, the dynamics are different. (see what happened in 2022) Analysts expected that high interest rates would cool the US and European economies, and a recession would set in as they rearranged their public finances and restructured their productive apparatuses behind the new-fangled protectionism introduced under the cloak of national security. In 2023, however, the recession hit Europe, with Germany leading the way, and Latin America, but not the US and Mexico, which, with a reactivation from the second quarter onwards, culminated in unexpected GDP growth of 3.3% and 3.4%, respectively. Asian countries with no inflation felt the Western cooling, but China especially felt the trade war measures against it by the Titan of the North. All of this resulted in the global economy slowing down relative to 2022, and the growth was led by Asia, specifically China with 5.2% and India with 7%.

The Western press narrative about what has happened in the global economy speaks of a recession in China and a boom in the US that is not only distant from reality but alien to it. Never before has the gap between the reality of the data in the Western press on China's economic dynamics been so stark in what appears to be a severe media cold war.

Western stock and commodity markets expected to cool with the interest rate hike did not fall but stalled and saw a strong rebound instantly from 27 October 2023 with the Gaza conflict. Unlike the Ukraine conflict, which had a very slight impact, this one has had marked positive effects, which shows the degree to which such a war well serves investors in the military-industrial complex. The sudden boom in the New York stock market does not imply an accelerated recovery of the US economy nor presage an easy recovery. Growth in 2024 is expected to be lower than in 2023, even for China, whose internal dynamics are failing to counterbalance the US trade war and the general cooling of the global economy. China and India will remain the two fastest-growing economies, dragging down the global economy.

Latin America also showed an unexpected performance. Mexico's projections were 1.6% but grew by more than 3.4%, and South America did not, except for Brazil, Paraguay and Bolivia. Price trends were predictably downward due to high-interest rates, despite the dynamics of China and the demand for metals induced by the substitution of electric vehicles. The drought in its seventh year fuelled the non-monetary part of inflation, noting the Panama Canal's reduced passage and navigation on the Parana River and the Amazon. All this hurts prices.

The US economy.

According to the New York Times (https://www.nytimes.com/2024/01/25/us/politics/yellen-criticizing-trump-says-bidens-economy-has-delivered-gains.html ), in a speech at the Economic Club of Chicago in late January 2024, Treasury Secretary Yellen, former Fed chairwoman and wife of Nobel laureate Ackerloff, argued that the Biden administration had led a recovery that has outpaced the rest of the world, which is not valid. She said that under President Trump, the US imposed tariffs on more than $300 billion of Chinese imports. She did not say how much the tariffs they imposed with neo-protectionism set into law. For example, the Biden administration has focused on creating its own $465 billion subsidy architecture through the CHIPS Act and Climate Science and Technology, with local content rules to protect its industry. All of this should have brought the consumer sentiment index back to pre-pandemic levels, but, as the graph below shows, it does not. The index declined from 101 in January 2020 to 61.3 in November 2023, according to the University of Michigan: Consumer Sentiment Index (https://fred.stlouisfed.org/series/UMCSENT/). Inflation declined in 2022 and 2023 but remains above the pandemic's start. The Fed's anti-inflationary policies do not consider the non-monetary elements of inflation, such as drought.

The problem the White House points out in the CHIPS and Science Act assessment a year later is that although the US invented semiconductors, they produce only 10% of the world's supply and none of the most advanced chips. "Similarly, investment in research and development has fallen to less than 1% of GDP from 2% in the mid-1960s, at the height of the space race." (https://www.whitehouse.gov/briefing-room/statements-releases/2023/08/09/fact-sheet-one-year-after-the-chips-and-science-act-biden-harris-administration-marks-historic-progress-in-bringing-semiconductor-supply-chains-home-supporting-innovation-and-protecti) On the other side Huawei, facing the US blockade started in 2022, introduced the Huawei Mate 60 Pro model in September 2023 which contains a proprietary processor, the Kirin 9000S, with 7 nanometre lithography, a milestone in the technology war with the US made by Semiconductor Manufacturing International Corporation based in Shanghai. In other words, they are ahead of the US and autonomous from them in their progress.

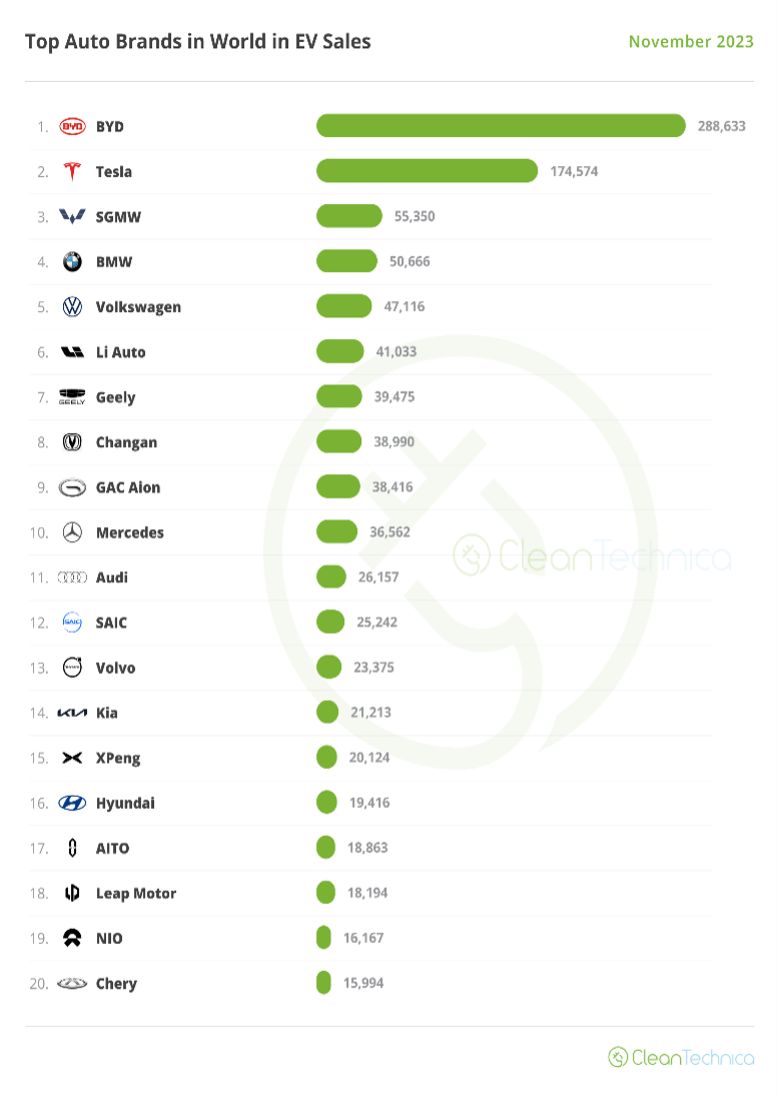

In the automotive industry, where China has led for a decade, the Western press portrays Tesla as the leading and almost the only firm, while at least the German and Korean brands are transitioning to electric, and China's brands lead by a wide margin.

The graph shows that of the top 20 car brands selling the most electric vehicles in the world, one is American, four are German, two are Korean, and the other 13 top-selling brands are from China. In September 2023, Chinese electric vehicle companies exhibited their products at the Munich Auto Show and dazzled.

On that occasion, experts pointed out that such companies could challenge conventional car companies. Tesla CEO Musk said, "Chinese companies are the most competitive globally. So I think they will achieve considerable success outside of China, depending on what tariffs or trade barriers are put in place". (https://www.cnbc.com/2024/01/25/elon-musk-says-chinese-ev-makers-will-demolish-other-companies.html) Only with tariff protection will Western companies be able to compete, and of these, German companies are in the best competitive and market position in the West. Unlike the Koreans, the giant US and Japanese brands are not among the world's top 20 best-selling brands in these vehicles.

Latin America and inflation

All Latin American countries raised interest rates during the year in tandem with the Fed to avoid adverse exchange rate movements. The most successful were Brazil and Peru, which have kept their exchange rates stable despite the political headwinds in their countries. Chile and Colombia saw adverse movements, but their inflation rates declined and were not affected by them. All exchange rates appreciated, reflecting the Fed's monetary policies and all central banks accumulated more international reserves due to the austerity policies that are now the new norm. Drought-related inflation and the fall in exports for the same reason impacted the Atlantic breadbasket countries such as Uruguay, Argentina and Brazil more and less on the Pacific. The Pacific economies are affected by mineral prices that fell or failed to rise, plus the drought. The result has been that, except Mexico, Brazil, Paraguay and Bolivia, all have stopped growing. The fourth fastest growing was Bolivia with 2.3%, Brazil with 3.1% was the third, linked to China, after Mexico, the second, linked to US growth and both to domestic demand. It is the ninth largest economy in the world and, in nominal terms, displaced Canada. Of the G7, only four countries remain in the top 10. Brazil's driving force was grain exports, which, although they fell in volume, grew in prices and social spending, similar to Mexico's.

According to the World Bank (https://www.worldbank.org/en/country/brazil/overview), Brazil faces significant, recurrent and increasing losses due to weather-related events. Despite this, one-third of export revenue is of agricultural origin, and almost half is sold in the East, essentially China, followed by Europe.

The first fastest growing country is Paraguay, according to ECLAC, with 4.5%, which is explained by the performance of agriculture in the soybean sector, as well as energy production - sale to Brazil of hydroelectricity from the Iguazú Falls - and re-exports.

BRICS and its enlargement

In August 2023, BRICS member countries agreed to add six more countries to the group, which included Argentina. The aim was to have more international negotiating capacity in the face of what they perceive as an upside-down world. The US has the highest public debt in the world in absolute terms. Like all fiscal deficits, it comes with external deficits, which are symmetrical: excess consumption over domestic production leads to imports of goods and services. In a standard world economy, this would pull world growth. All indications are that it only pulls Mexico and possibly Canada. China's economic activity leads the rest of the world. The BRICS countries have substantial international reserves and cover a part of the external resources the Titan of the North needs. Faced with this evidence, the BRICS agreed to negotiate with them to revive the Global South's economies, which are now thrifty because they are under a regime of austerity imposed first by the IMF and then by the international press and rating agencies. The new world order comprises a big spendthrift that grows little while the rest of the world saves without growing, except for China, India and the Asian countries. Europe, on the other hand, is financing itself.

China accelerated the unwinding of US Treasuries and reduced its position in these instruments while increasing its position in gold and other currencies. This year, there was more talk, in general, of trading operations in domestic currency. In this game, Argentina, which lacks international reserves and has a large economy, renounced a swap agreement between central banks from the People's Bank of China made in yuan five years ago. This agreement allows for South-South financial cooperation and dispenses with conditionalities. However, Argentina withdrew from the agreement with the BPdeC in the last month of the year and thus forced other institutions to bail it out. The FED did not step in to bail it out, as might be expected as a substitute for China. Between 2008 and 2021, China invested $240 billion to bail out 22 developing countries, according to researchers. Among the primary beneficiaries are Argentina, Pakistan, Mongolia and Egypt. The People's Bank of China provided $170 billion individually to foreign central banks through its bilateral swap lines. Chinese state-owned enterprises also played an essential role in this bailout process. The BCRA's withdrawal from the BPdC is for reasons of alignment with the US and not for financial reasons. The Fed did not react.

With the Arab countries joining the BRICS, the group's aggregate level of international reserves grew even more, and the possibility of pressuring the US to adjust and reduce its immense deficit grew even more. Standing in the way was the Gaza war on 22 October 2023. All indications are that the adjustment policies of the Global South will continue in 147 countries while one maintains a public debt of 30 trillion dollars, equivalent to half of the world's GDP and 120% of its GDP. The outgoing Democratic administration of President Biden tried to stop the increase in this debt from 2020, as can be seen in the graph, with the consequent loss of popularity.

Finally, China leads global growth driven by changes in energy and transport as well as telecommunications and its input, chips. Competition between the great powers is open and reminiscent of the earlier competition between Germany and Britain in the age of inventions. That ended with the First World War. The economic mood is that the West is growing slowly, and the East is growing fast. The difference is that the significant investment funds are in the West and control the investment flows. The year 2024 is expected by the IMF and investment houses, to be slower than 2023, which was in turn less than 2022, the year of the pandemic's rebound. As OBELA said at the time, the recovery would be in the form of an inverted square root, which indicates this is true in the West. The East did not experience a downturn, so its economic dynamics do not have that shape. The change in the global economic axis is consolidated in 2023, with the East at the forefront and the Pacific Ocean as the centre of world trade.