In 2020, the Fed and other G7 central banks cut interest rates and doubled their money supply to combat the economic crisis. By the end of 2021, the dilemma was whether to raise interest rates to fight inflation or leave them low to avoid a further slowdown. In March 2022, the Fed decided to prioritise inflation and began a tight monetary policy. However, in March 2023, inflation in the US and the Eurozone was still high, which meant high-interest rates to combat it. G7 central banks in 2023 juggle inflation and financial system stability with two separate instruments, the interest rate and their balance sheet (system liquidity). It represents a crisis of unconventional monetary theory and a conceptual problem. The interest rate cannot keep inflation in check because factors beyond central banks' control influence the actual scale of prices. At the same time, increasing central banks' liquidity and balance sheet is a theoretical contradiction, but that is what they are doing in the face of what appeared as a banking crisis at the beginning of March. In the meantime, global warming continues. The text aims to show what can be expected in the context of the under-theorised inflationary control instruments and the banking function change. Central bankers designed the Basel regulations to minimise credit risk, and the reality shows that the risk is for bank investments in a climate of rising interest rates in the world.

The banking problem

The banking problem is not surprising, as it results from the evolution of banking and its structure over time. The number of banks in the US has shrunk dramatically, with only 4,706 banking institutions in the fourth quarter of 2022, a quarter of what it was in 1984 and a half in 2007. The reduction is mainly due to mergers, which have led to the 13 largest banks controlling 60% of total banking assets in the US. However, only JPMorgan Chase & Co, Bank of America Corp, and Wells Fargo & Co. are among the top ten in places 6, 8 and 9. The others are essentially from China.

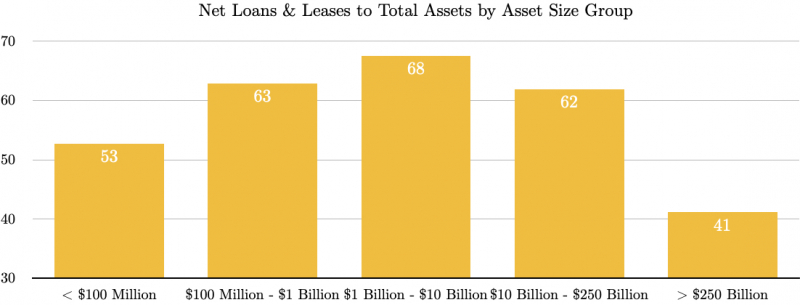

It has led to a concentration of bank assets, reflected in a Gini index that has risen, in the USA, from 0.83 in 1984 to 0.95 in 2022. The regulatory problem is that the most prominent Western banks have moved away from lending as their primary source of income and are more inclined to invest in securities, structured products, and Treasury bonds. It links their earnings to financial markets and increases their exposure to market risks. Banking regulations agreed upon from Basel I to Basel III revolve around lending and its quality. The smallest banks in the US invest 47% of their deposits and capital; the next largest, with less than $1 billion in assets, invest 37%; those between $1 billion and $10 billion invest 32%; those between $250 billion and $10 billion invest 38%, and the thirteen largest banks, with more than $250 billion in assets, invest 59%. As agreed at the Bank for International Settlements, the regulators follow the lending but do not look at investments, which are a fundamental part of contemporary banking activities. The banking function that used to consist of receiving deposits and channelling these resources from third parties to third-party investments has been transformed into receiving deposits from third parties, dealing with them on its own account, and returning the reference interest rate to the clients. The profits stay with the bank. Of course, when there are losses, society covers them in a new kind of banking socialism. We will see a lot of banking socialism in 2023 and criticism again of the lack of regulation. The banking crisis is partly due to the lack of diversification in banks' investment portfolios. Many concentrate on complex and high-risk financial products, such as structured mortgage-backed products. The critical problem is that there is less banking competition globally, and it is more concentrated than ever in history. More competition would avoid these problems, and banks would also return to being intermediaries between depositors and borrowers. Their transformation into proprietary investment banks with public money differs from the original definition of intermediaries.

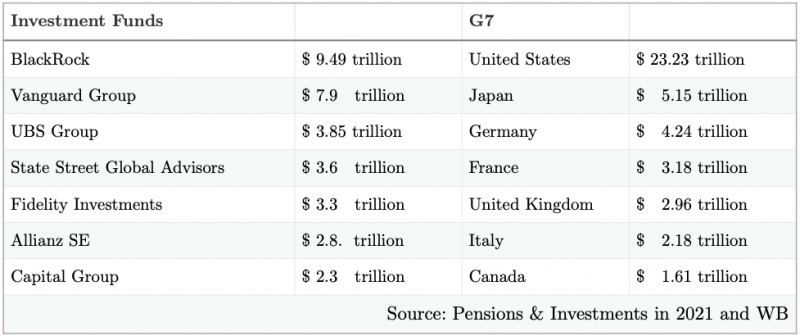

What is new is that the function that banks once fulfilled is now in the hands of unregulated investment funds. The size of these is that of the G7 countries.

What is new is that the function that banks once fulfilled is now in the hands of unregulated investment funds. The size of these is that of the G7 countries.

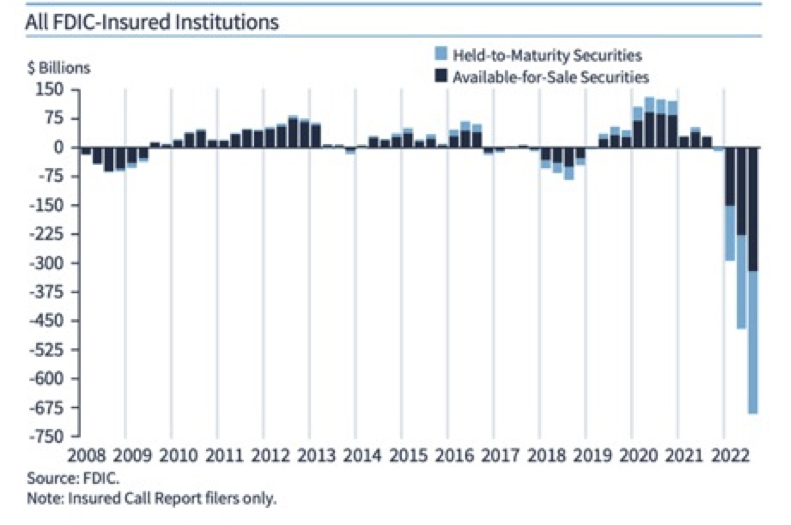

Rising interest rates and shrinking balance sheet balances have led to cumulative losses in US financial markets throughout 2022. The FDIC, the US Federal Deposit Insurance Corporation, warned about this situation as early as the first quarter of 2022, when unrealised losses by banks showed up, which by the end of the year exceeded $700 billion. The question is, what happens when the size of a bank is larger than the national economy? In the case of Credit Suisse, the country has a GDP in 2022 of 808 billion dollars, and the bank rescued by UBS has assets and capital of 1.7 trillion dollars, more than twice as much. The size of losses in a bank of this size can be a national problem. The UBS group as a whole is four times the size of Switzerland.

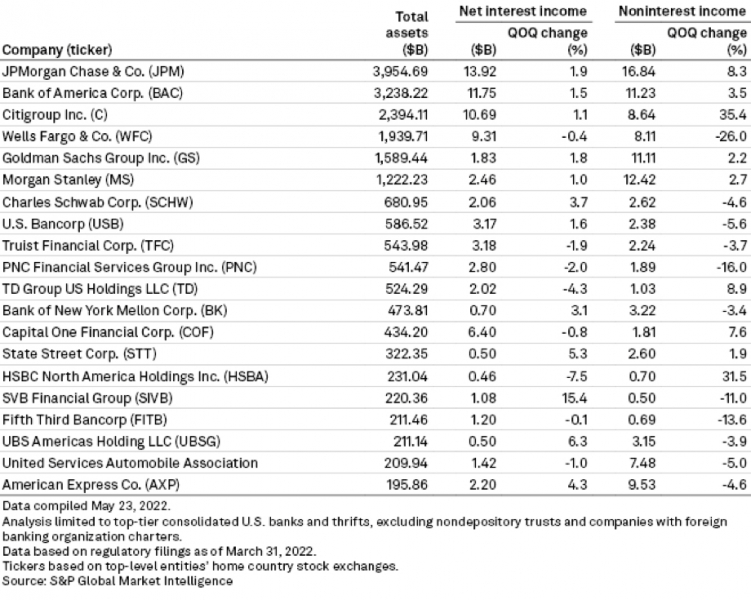

Largest US bank. Interest and investment income, trim. I 2022

Ranked by total assets as of 31 March 2022

In Europe, the situation is analogous to the North regarding the recession induced by the interest rate hike. The ECB published its economic projections, which included a downward revision of inflation expectations, mainly due to lower energy prices, with figures of 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025. When they realised that inflation has non-monetary components that are not affected by the interest rate, the ECB announced in March a rate hike arguing that inflation will remain "too high for too long". The view from Europe that what happens in the US does not affect them does not register that they are subordinate to the policies of the Fed, like the rest of the Western world. The run first against Credit Suisse and then Deutsche Bank in March has come to refresh the memory that the old world is part of the world and is not cooked separately. The European recession is here to stay with the US recession of '23, and the banking events will only deepen it. Traders will most likely continue to blame the war in Ukraine, but the truth is that global financial instability since market deregulation has been a constant feature.

(UNREALISED) GAINS AND LOSSES ON INVESTMENT SECURITIES

Drought and its effects

Environmental problems have continued their course from the previous year. The World Meteorological Organization (WMO) predicts that the El Niño phenomenon will occur in the tropical Pacific Ocean from July to August 2023, which may significantly impact the global climate. During El Niño episodes, some regions may experience droughts and high temperatures, while others may experience floods and colder-than-usual winters. The arrival of El Niño in 2023 may have four significant potential effects: a 0.2°C increase in average global temperature, droughts and the potential for wildfires in Australia, climate disruption and reduced CO2 absorption in South America, and colder winters in northern Europe. Due to global warming, the El Niño influence over the North Atlantic and northern European winters is expected to strengthen. It comes on top of droughts that started six years ago and changing global water regimes, with countries flooded while others are dried. The impact will be on food prices. Already in 2022, there is a reduction in food production worldwide except in Australia and South America, which has affected inflation in the basic food basket. On top of this will come this year's El Niño. It is out of the existing abnormal weather changes on the South American equator and the volumes of water discharged in January and February in Ecuador, Peru and Brazil.

Meanwhile in Asia…

China expects a growth rate of 5.2% which contrasts with the lack of growth in the West. Inflation remains at around 3%, less than half that of the West. Therefore, the benchmark interest rate of the PBOC is 2.75%, with a slightly negative real interest rate to accelerate the economic dynamics of investment and consumption. The Eastern giant has an economic scenario at the antipodes of the West that will be the basis for global economic growth, which will be low but will have some effect on South America. The US recession is a hallmark for Mexico and Central America, and it will be difficult for them to avoid this reality.

The construction of a Chinese financial architecture parallel to that of the West, including the central bank's activity as an international reserve bank, the growing use of the yuan in international trade, the development of a Shanghai-based commodity market denominated in yuan, a global payments mechanism for yuan transactions around the world, and two development banks, the BRICS Bank and the Asian Infrastructure Investment Bank, place China in a unique position to shape the global economy. The largest banks in the world are Chinese and are engaged in lending, not investing for their account. Add to this the growing role of Chinese commercial banking, with the world's three largest banks and four of the world's six largest banks overtaking all Western banks.

China's new role in the Middle East has changed the global oil market and must be added to its banking prowess. The Iran-Saudi Arabia peace deal brings a growing trade between the Eastern Dragon and its two Western neighbours. Already the leading oil buyer from both countries, the two countries are consolidating a long-term agreement that could assist in developing the yuan oil market. In addition, China's Silk Road agreement with Syria signed in '22 opens up relations between the two countries and allows Syria, a country subject to Western economic sanctions, and Iran and Venezuela to trade in yuan and otherwise store their international reserves. Finally, there is Xi's deal with Putin. Russia is China's leading oil supplier, which it buys through pipelines built by China with its funds. The Asian dragon has 66 pipelines covering a limited part of its territory but connecting it to Russia. Trade with Iran and Saudi Arabia will be by the sea. According to Forbes magazine estimates, the oil price will not fall below $80 a barrel, and projections are that imports will increase compared to last year. All indications are that the country is buying oil for storage or to trade refined oil from Shanghai in yuan in head-to-head competition with the US, whose main export is refined oil.

Conclusions

Finally, with the West stagnating and the East dynamic, the East will determine commodity prices, despite the high-interest rates that put downward pressure on prices. Exports from the Caribbean Basin countries, including Colombia, will be severely affected by stagnation in the West. The rest of South America should maintain some dynamism for these reasons. Climate change and water scarcity may play against it.

In 2020, the Fed and other central banks cut interest rates and doubled their money supply to combat the economic crisis. However, at the end of 2021, they faced raising interest rates to fight inflation or leaving them low to avoid a further economic slowdown. In March 2022, the Fed decided to prioritise inflation. It began a tight monetary policy, but in March 2023, inflation was still high, which has led the G7 central banks to juggle between inflation and the financial system's stability.

The concentration of bank assets in large financial institutions needs to be improved, as their exposure to market risks is higher due to their investments in securities and structured products. Banking regulations have not kept up with this evolution of the banking function, focusing on lending rather than investment, resulting in a lack of diversification in banks' investment portfolios.

The transformation of banks into proprietary investment institutions has led to a lack of banking competition worldwide, which has contributed to the current banking crisis. Banks must return to their original function as intermediaries between depositors and borrowers to avoid future banking crises.

Drought and the effects of climate change are a growing global problem, which could worsen with the El Niño phenomenon expected in 2023. Droughts and climate disruptions can have a significant impact on food production, which can affect inflation and food prices.

The drought will undoubtedly be a drag on everyone. It will sustain inflation as the water shortage impacts food prices, and microchips needed for the industry remain in short supply. As a general trend, the protectionism pioneered by Washington will likely be copied by others, despite resistance from the WTO. Indonesia's example of industrialisation is likely to be studied and followed by governments with greater degrees of freedom in defining economic policy.

China's growing economy contrasts with the need for more growth in the West. China is building a financial architecture parallel to the West's that puts it in a privileged position to shape the global economy. China is also playing an increasingly important role in the global oil market and establishing essential trade agreements with countries in the Middle East.

For Mexico and Central America, the recession in the United States is a hallmark that is difficult to avoid. It indicates that these countries may face severe economic challenges shortly.

The West's leadership is weakening, and the strengthening of the East is emerging not only economically and technologically but politically, as seen in Iran's peace deal with Saudi Arabia. Note the power of the Shanghai commodities market and the possible export of refined gasoline in yuan after making agreements with US-sanctioned countries that cannot export oil and limit refined exports from the US.

China will continue to conquer Latin American markets for cars, electric vehicles, electric passenger and freight transport, and to buy up electricity distribution companies and create renewable electricity generation parks. At the same time, it finishes selling the fossil fuel cars it replaces at home and takes the market for them away from the West.

In summary, the text highlights the importance of awareness of the global and regional challenges we face regarding climate change, economics and politics and how these can affect people's daily lives worldwide.

[1] Instituto de Investigaciones Económicas UNAM, coordinator OBELA, SNI III/CONACYT

[2] OBELA is composed of Dr Alberto Tena, post-doctoral student IIEC UNAM, DGAPA grant; Luis Colin, Faculty of Economics, Conacyt grant; Gabriela Ramírez, Faculty of Economics, CONACYT grant; Bertín Acosta Bautista, Faculty of Economics, CONACYT grant; Monserrat Granillo Hernández, Faculty of Economics, CONACYT grant.

Download / Español