During the past year, there is a general inflation increase worldwide. The reasons for this are pretty heterogeneous. Beyond reducing the explanation to supply and demand, it is necessary to bear in mind the structural characteristics of each particular market, and the effects of fiscal, monetary and regulatory policies (more).

Among the infinite number of commodities available on the international financial market, gas is one of these. Due to their relevance and minimal qualitative differentiation, it is traded wholesale on international markets both in spot (current rates) and futures. It exposes them to market volatility, making them highly sensitive to market expectations and interest rate variations.

This international trading is the first part of value formation. It involves extraction companies whose supply depends mainly on the expected rate level because specific extraction methods, such as shale gas require a higher amount benchmark to be profitable. Therefore, there are no supply constraints as long as the worth remains high. Gas availability should not be a difficulty under normal market conditions.

Government-owned companies produce the gas consumed domestically, whose value is subject to their production costs rather than the fee set on financial markets. In Mexico, gas imports are close to 80% and in Chile 78%; Peru, although a net exporter of natural gas, is a net importer of liquefied petroleum gas (LPG).

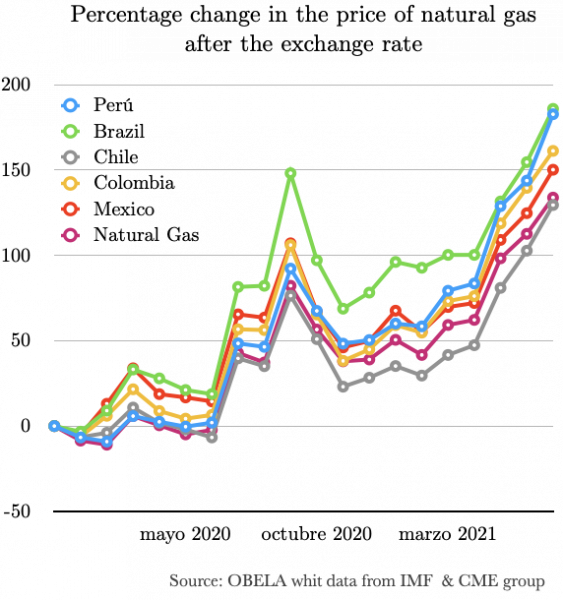

First, by depending on gas imports, it is subject to international outlays, which have been affected by the excess liquidity in the market due to the unconventional monetary policy used by the Federal Reserve since March 2020. In addition, imports are in US dollars, so the consumer amount is directly affected by the exchange rate.

The final amount paid by the consumer is not the international worth. Transportation, storage and distribution costs that accumulate from the extraction wells to the final consumer are relevant. In general, the state usually owns pipelines and infrastructure needed for gas transportation of regulated monopolies because of the magnitude and installation costs involved.

Private companies import, store, distribute and sell the final fuels, and in Peru, they represent 65% of the final value. Brazil, Colombia and Mexico experience a similar situation, with a few companies concentrating on storage and distribution. The lack of competition in the sector has an essential effect on the outlay to consumers, as demand is stable regardless of the cost. Competition authorities in Mexico and Chile have already initiated investigations into this issue.

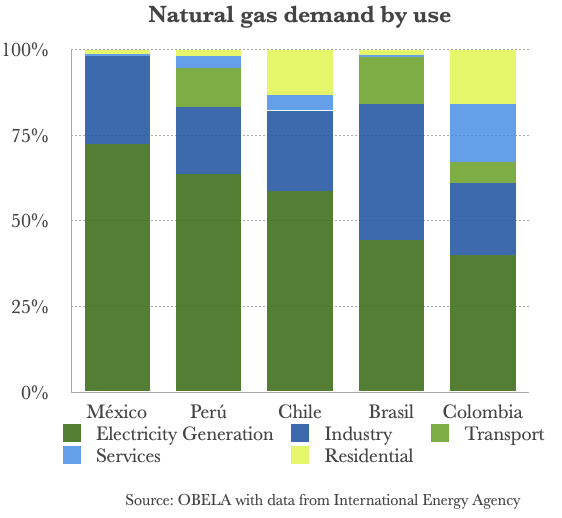

In Latin America, domestic consumption is a small part of total demand. For example, in Mexico, household use of gas barely exceeds 1%, while around 60% goes to electricity generation and 21% to industry. In Peru, 55% is for electricity generation, 18% for industry and 1.5% for residential consumption. In general, these consumption patterns are pretty similar in the region's countries, with the only exception of Argentina and Chile, which have higher domestic consumption, especially during the winter.

The economic contraction and slow output recovery indicate that the demand for gas as an energy source to power industry and electricity generation has not put pressure on the market.

Although internal oligopolistic structures in the region lead to higher rates and are subject to regulation by competition authorities, most of the increase in gas values is due to excess liquidity in the market, which has led to a general rise in the worth of raw materials. Moreover, as gas is an input for industry and power generation, increasing its international outlays may lead to higher production costs that are passed on to other products and lead to higher inflation.

Download