Since 1990, the idea of central bank independence from national governments has become universal. It materialised with constitutional changes in some countries and legal changes in others, which prevent the central bank from financing public finances, except for the G7 countries and China. This principle goes with the unrestricted opening of capital accounts and the complete deregulation of financial markets. Additionally, with 60% of the world's GDP in dollar bills, monetary policy and interest rates in the world are in the hands of the Fed, except in China.

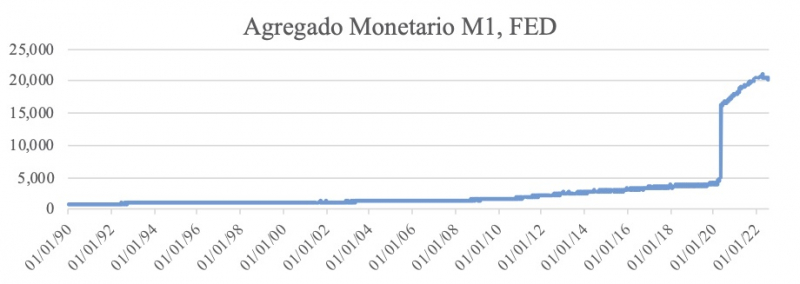

Central banks are independent, and three decades later, they all use the target inflation rate model and their theoretical and regulatory frameworks. However, as of March 2020, the Fed doubled the U.S. money supply to 30% of GDP. One consequence is that the U.S. will go through the highest inflation in forty years in 2022, which has infected the rest of the Western world. Additionally, there are other inflation components already discussed (links), and to that is added the most recent rise in energy costs due to the war in Ukraine.

The assumption was that central bank autonomy and balance sheet control would allow price stability in the long run and lead to higher economic growth. Monetary policy is a crucial instrument of macroeconomic stabilisation. In March 2020, the FED intervention meant stabilising the stock and commodity markets and bailing out companies. The Dow Jones Industrial Average lost 40% of its capitalisation value between February 13 (29,513 pts DJIA) and March 23 (18,213 pts). The Fed does not interpret autonomy as the ability to finance the Government but as its power to choose and use its instruments freely with its two objectives of growth and employment. The stability of the markets seems to be more important than the objectives mentioned above, and everything indicates that the economic press confuses stock market growth with economic stability.

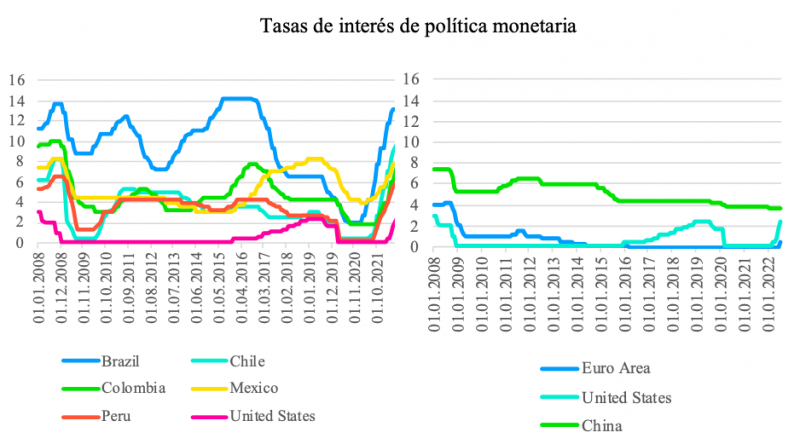

The IMF announced the issuance of 650 billion SDRs which is useless for emerging economies. It bulked up the international reserves of G7 and Latin American countries in U.S. Treasury bonds to finance the U.S. external deficit. The problem for Latin America is that the interest rate hike needs to be higher than the hike in the U.S. because of country risk, which will slow economic growth. A significant measure of the FED has been the end of Quick Easing with the subsequent increase in the basic interest rate. As a result, under the threat of an exchange rate depreciation, central banks in the West, and some in the East, raised interest rates. The ECB did not do so on the assumption that inflation was conjunctural, resulting in a 23% euro depreciation against the dollar in 2022. Europe thus became affected by capital movements against the euro, with the resulting increase in the dollar price, which hit the price of oil and gas denominated in dollars. As was Europe's growth rate, the ECB underestimated the inflation projections (1.5% by June 2021, 8.3% by September 2022).

Monetary policy should focus mainly on the long term, not only the Government and the political class influence the central bank. In the U.S., the big financial players do, as seen in 2008 and again in 2020

. The definitions of central bank independence differ between the G7 and the rest of the world. The Mexican constitution says, "no authority may order the bank to grant financing" (Article 28). The Chilean constitution states that "in no way may it grant them its guarantee, nor acquire documents issued by the State, its agencies or companies (Article 109). In the G7 central banking system, acceptance implicitly establishes the endogeneity of money, i.e., the central bank is the one that provides the liquidity demanded by the economy and therefore finances the state. Open market operations in the U.S. and the ECB allow state financing.

The ECB says "to operate in the financial markets by buying and selling outright (spot and forward), or under repurchase agreements, lending or borrowing securities and other negotiable instruments, whether in euros or other currencies." (Article 18 of Chapter IV of the Statute of the European System of Central Banks and the Central Bank). The Fed's charter on open market operations states: "The Federal Open Market Committee sets monetary policy by choosing a target for the federal funds rate and authorises open market operations (purchases and sales of Treasury bills) to achieve that target".

For China, the hike has had no effect as they have a closed capital account and are net buyers of commodities. China lowers its interest rate to revive consumption given the difficulties observed by the continuation of COVID and the effects of the drought, expecting a growth rate of 4.8% in 2022. With the capital market regulated and the capital account closed, the People's Bank of China demonstrates its autonomy from the Fed. It is something that the ECB and African and Latin American banks have lost with dire consequences for economic policy. In what terms can recovery of monetary and macroeconomic policy autonomy be made possible?