THE ROAD TO RECESSION: THE INADEQUACY OF MONETARY POLICY

- blog de bacosta

- 734 lecturas

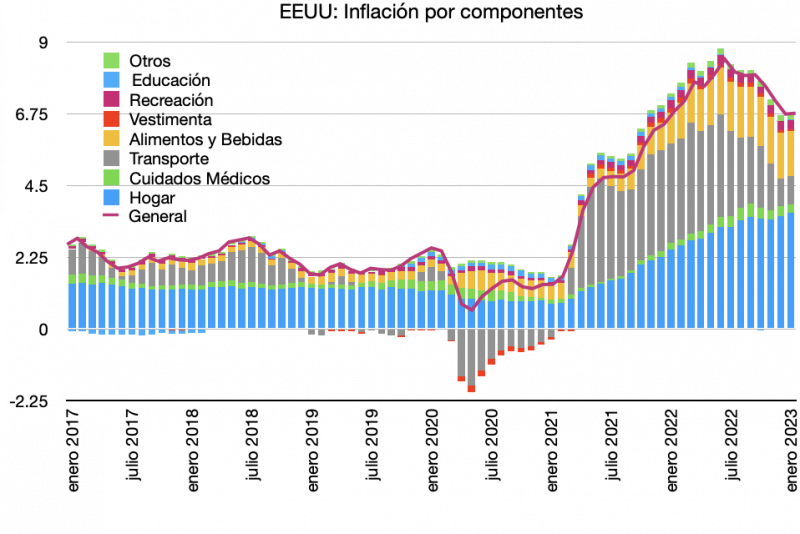

During 2022, the prices of goods and services (global %) experienced an increase, which has generated social unrest in several countries. Central banks raised their rates to control the price rise, discouraging investment, reducing consumption and increasing concerns about a recession. Meanwhile, food prices continue to rise. This article discusses the inadequacy of monetary policy to control rising costs.

US inflation for January 2023 is already down from its highest level. The monetary aspects have already subsided, but the structural elements have not, namely housing and food, which account for ¾ of the US price index. Personal disposable income is reduced for other expenditures as housing and food prices rise. People are unable to meet their basic needs. Something similar is happening in all Western economies, resulting in social unrest and protests, as has been observed before. Price rises have yet to be followed by wage rises, thus depressing living standards.

Partial explanations for the increase in food prices are global value chains that have not yet been fully re-established, the partial shutdowns in China and the delays they generate, and the Russian-Ukrainian conflict over grain and fertiliser markets . These causes respond to the international market structure that has concentrated the production of certain products and has established the start of many value chains in Asia. Global drought and floods ruin harvests [Insert article Water Gaby ], increase investment risk and reduce the supply of agricultural products. They can also limit electricity generation and thus create disruptions in production processes.

Rising interest rates discourage investment in food production when the cost of financing for producers increases significantly, leading to a reduction in food supply and a further increase in prices. On the other hand, higher interest rates reduce personal disposable income by using more money for consumer credit payments and fail to reduce the rise in prices effectively—all of the above fuels it. For example, it is necessary to increase urea production for fertilisers to reduce the cost of agricultural output. However, with the high-interest rate, US finance access is 4.5% more expensive than a year ago. In Mexico, the base interest rate rose to 11%, Brazil to 11.75%, Peru to 7.75%, Chile to 11.25% and Colombia to 12.75%.

Governments need to take measures in addition to monetary policy to prevent inflation from being sustained. These could include specific policies to support urea production, reduce food production costs, and fuel subsidies. In addition, it encourages innovation in agriculture and the development of water management technology, and improves infrastructure and transport logistics to facilitate distribution.

The increase in US federal funds yields led to reduced durable goods purchases and increased credit card balances. It indicates that consumers use credit cards to cover their basic needs, including food. The result is that there is an increase in defaults. The context is that unemployment data indicates a reduction to 3.9% of the population. The evidence shows that these must be meagre wage jobs. Globally an increase in poverty and income inequality is observed.

As we have seen, sustained food inflation has very detrimental effects on the economy and society, if there is no wage adjustment to compensate for it. Monetary policy is insufficient to address it. In addition, central banks should pay attention to the external factors that affect it, such as the internatilonal concentration of production and climate change. As a result, there must be public policies aimed at increasing domestic production and reducing external dependence on food.