The distributional problems of inflation and the limits of monetary policy.

- blog de bacosta

- 1438 lecturas

The Fed remains resolute in its policy of raising interest rates. In its statements, it shows particular concern about an imbalance in its labour market following the social protection policies during the pandemic in the USA. The central banks of the peripheral countries in Latin America, which cannot afford to depreciate their currency against the dollar, are following the same path but with a very different scenario regarding income distribution and the labour market. The region heads towards a recession which, added to the food and climate crisis, may further aggravate the situation of the lowest-income population in the global South. Peripheral countries must explore alternatives and develop protective measures in an environment of high inflation and low or no growth, given they lack monetary policy independence.

At the press conference for the Fed's latest announcement on 21 September, Fed Chairman Powell stated how the institution remained concerned about US wages: "Job growth has been very strong, averaging 378,000 (new) jobs per month over the past three months. The labour market remains unbalanced [...] we expect supply and demand conditions in the labour market to become more balanced over time, which will ease upward pressure on wages and prices". Although the US recovery has been driven primarily by employment rather than unit wage growth, the pandemic and protective policies generated an equalising effect at the bottom, with significant gains at the bottom of the distribution. After taxes and transfers, real disposable income for the bottom 50% was 20% higher in 2021 than in 2019.

In this context, the US is experiencing a wave of unionisation. According to a recent Gallup poll, although unionisation remains relatively low, Americans' support for unions has been the highest since 1965. The National Labor Relations Board reported a 57% increase in union election filings in the first six months of 2021. Since December 2021 at Starbucks (9,000 coffee shops nationwide, with 220,000 workers), nearly 300 of these shops have voted to unionise; April 2021 saw the first independent union at retail giant Amazon, the country's second-largest employer with more than a million workers. The same has happened at Trader Joe's supermarket chain (550 shops and 50,000 employees), in its shops in Massachusetts and Minnesota, which have already pushed for labour improvements to prevent their extension. On 27 August, workers at the Chipotle Mexican Grill fast food chain in Lansing, Michigan, became the first of the chain's 3,000 locations, which employ nearly 100,000 people, to organise into a union.

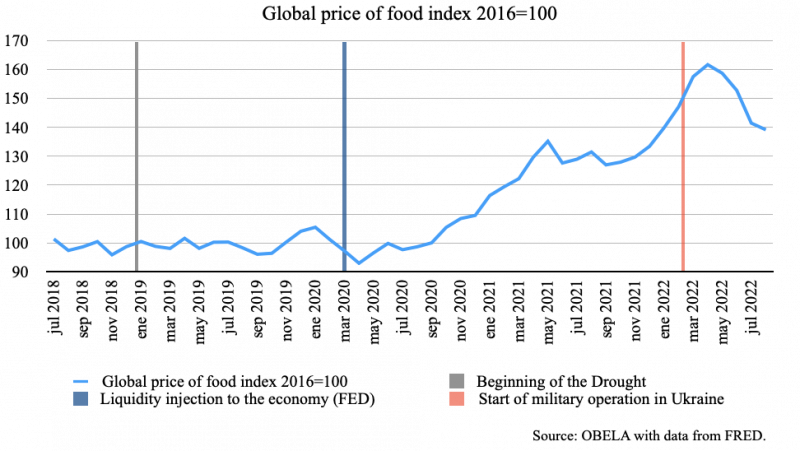

These circumstances are different in Latin America. By 2021, average real wages in Latin America and the Caribbean (average of 12 countries) had lost 6.8 per cent of the value they had in 2019, according to ECLAC-ILO. In 10 of the 14 countries reviewed, employment by early 2022 had not recovered to the 2019 values; in half, the gap was around 5%. Employment recovery was equally driven by the growth of informal occupations, accounting for between 50% and 80% of the net jobs increase between the third quarter of 2020 and the first quarter of 2022. Most dangerously, food price growth has since at least February 2020, driven by droughts stemming from the climate crisis and lately only aggravated by the war in Ukraine.

In this context, rising interest rates and a recession in the region will only worsen the situation, with no guarantee that they will address the non-monetary causes of inflation. Significant inequalities also call into question the effectiveness of monetary policy transmission. Low-income households, with less access to banks and financial markets, tend to be less directly affected by interest rates and suffer most from food price rises.

Future Fed rate hikes will continue to be driven by distributional problems internal to the US labour market and will push other central banks to raise rates to keep exchange rates stable. Monetary subordination forces Latin American countries to explore options in the face of a global recession. While regulatory policies such as minimum wages or price controls are essential, combinations of monetary policy and monetary tightening are also needed to keep exchange rates stable.

Download / Español